Zurich Insurance Group Annual Report 2012 Operating and financial review 107

Indebtedness

Previously presented details of debt issuances in the Operating and financial review are now set out in note 21 of the

Consolidated financial statements.

Capitalization

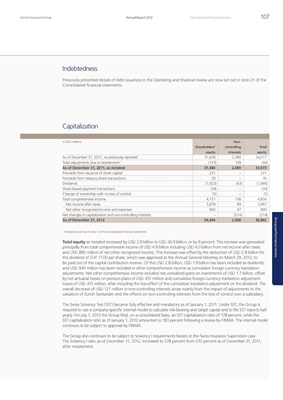

in USD millions Non-

Shareholders’ controlling Total

equity interests equity

As of December 31, 2011, as previously reported 31,636 2,380 34,017

Total adjustments due to restatement 1 (153) 109 (44)

As of December 31, 2011, as restated 31,484 2,489 33,973

Proceeds from issuance of share capital 221 – 221

Proceeds from treasury share transactions 30 – 30

Dividends (1,923) (43) (1,966)

Share-based payment transactions (34) – (34)

Change of ownership with no loss of control (5) – (5)

Total comprehensive income 4,721 136 4,856

Net income after taxes 3,878 89 3,967

Net other recognized income and expenses 843 47 890

Net changes in capitalization and non-controlling interests – (214) (214)

Group performance review

As of December 31, 2012 34,494 2,368 36,862

1

Restated as set out in note 1 of the Consolidated financial statements.

Total equity as restated increased by USD 2.9 billion to USD 36.9 billion, or by 9 percent. This increase was generated

principally from total comprehensive income of USD 4.9 billion including USD 4.0 billion from net income after taxes

and USD 890 million of net other recognized income. This increase was offset by the deduction of USD 2.8 billion for

the dividend of CHF 17.00 per share, which was approved at the Annual General Meeting on March 29, 2012, to

be paid out of the capital contribution reserve. Of this USD 2.8 billion, USD 1.9 billion has been included as dividends

and USD 840 million has been included in other comprehensive income as cumulative foreign currency translation

adjustments. Net other comprehensive income included net unrealized gains on investments of USD 1.7 billion, offset

by net actuarial losses on pension plans of USD 451 million and cumulative foreign currency translation adjustment

losses of USD 415 million, after including the loss effect of the cumulative translation adjustment on the dividend. The

overall decrease of USD 121 million in non-controlling interests arose mainly from the impact of adjustments to the

valuation of Zurich Santander and the effects on non-controlling interests from the loss of control over a subsidiary.

The Swiss Solvency Test (SST) became fully effective and mandatory as of January 1, 2011. Under SST, the Group is

required to use a company-specific internal model to calculate risk-bearing and target capital and to file SST reports half

yearly. For July 1, 2012 the Group filed, on a consolidated basis, an SST capitalization ratio of 178 percent, while the

SST capitalization ratio as of January 1, 2012 amounted to 183 percent following a review by FINMA. The internal model

continues to be subject to approval by FINMA.

The Group also continues to be subject to Solvency I requirements based on the Swiss Insurance Supervision Law.

The Solvency I ratio as of December 31, 2012, increased to 278 percent from 232 percent as of December 31, 2011,

after restatement.