Zurich Insurance Group Annual Report 2012 Consolidated financial statements 203

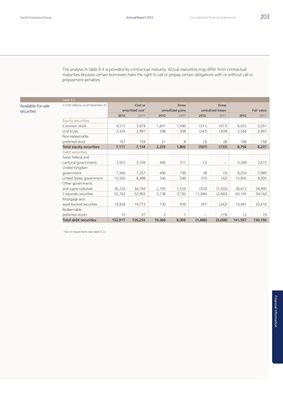

The analysis in table 6.4 is provided by contractual maturity. Actual maturities may differ from contractual

maturities because certain borrowers have the right to call or prepay certain obligations with or without call or

prepayment penalties.

Table 6.5

Available-for-sale in USD millions, as of December 31 Cost or Gross Gross

securities amortized cost 1 unrealized gains unrealized losses Fair value

2012 2011 2012 2011 2012 2011 2012 2011

Equity securities

Common stock 4,515 3,979 1,841 1,490 (331) (417) 6,025 5,051

Unit trusts 2,434 2,997 398 309 (247) (309) 2,584 2,997

Non-redeemable

preferred stock 167 159 21 8 (3) (8) 186 158

Total equity securities 7,117 7,134 2,259 1,806 (581) (733) 8,796 8,207

Debt securities

Swiss federal and

cantonal governments 3,925 3,104 466 511 (3) – 4,388 3,615

United Kingdom

government 7,566 7,257 496 736 (8) (3) 8,054 7,989

United States government 10,560 8,498 340 549 (55) (42) 10,845 9,005

Other governments

and supra-nationals 36,226 34,744 2,795 1,553 (350) (1,302) 38,672 34,995

Corporate securities 55,792 52,902 5,738 3,720 (1,386) (2,460) 60,145 54,162

Mortgage and

asset-backed securities 18,838 19,713 730 939 (87) (242) 19,481 20,410

Redeemable

preferred stocks 10 37 2 1 – (19) 12 19

Total debt securities 132,917 126,255 10,568 8,008 (1,888) (4,068) 141,597 130,196

1

Net of impairments (see table 6.2).

Financial information