Zurich Insurance Group Annual Report 2012 Consolidated financial statements 253

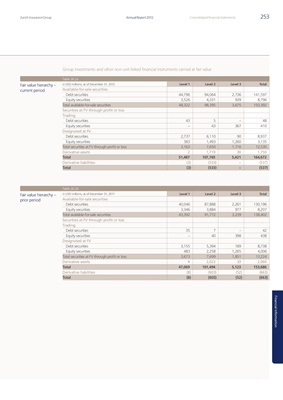

Group investments and other non-unit linked financial instruments carried at fair value

Table 26.2a

Fair value hierarchy – in USD millions, as of December 31, 2012 Level 1 Level 2 Level 3 Total

current period Available-for-sale securities

Debt securities 44,796 94,064 2,736 141,597

Equity securities 3,526 4,331 939 8,796

Total available-for-sale securities 48,322 98,395 3,675 150,392

Securities at FV through profit or loss

Trading

Debt securities 43 5 – 48

Equity securities – 43 367 410

Designated at FV

Debt securities 2,737 6,110 90 8,937

Equity securities 383 1,493 1,260 3,135

Total securities at FV through profit or loss 3,163 7,650 1,716 12,530

Derivative assets 2 1,719 30 1,750

Total 51,487 107,765 5,421 164,672

Derivative liabilities (3) (533) – (537)

Total (3) (533) – (537)

Table 26.2b

Fair value hierarchy – in USD millions, as of December 31, 2011 Level 1 Level 2 Level 3 Total

prior period Available-for-sale securities

Debt securities 40,046 87,888 2,261 130,196

Equity securities 3,346 3,884 977 8,207

Total available-for-sale securities 43,392 91,772 3,239 138,402

Securities at FV through profit or loss

Trading

Debt securities 35 7 – 42

Equity securities – 40 398 438

Designated at FV

Debt securities 3,155 5,394 189 8,738

Equity securities 483 2,258 1,265 4,006

Total securities at FV through profit or loss 3,673 7,699 1,851 13,224

Derivative assets 4 2,023 33 2,060

Total 47,069 101,494 5,123 153,686

Derivative liabilities (8) (603) (52) (663)

Total (8) (603) (52) (663)

Financial information