302 Financial information Annual Report 2012 Zurich Insurance Group

Embedded value report continued

6. Acquisitions, capital movements and adjustments

Acquisitions

In 2011, the Group acquired businesses in Malaysia and Latin America. The impact of these transactions has now been

included for the first time in the Global Life embedded value as of December 31, 2012.

The life business acquired in Malaysia has been included in the Group consolidated IFRS accounts since December 31,

2011. However this is the first time the embedded value has been reported in Global Life and it has been recorded

as a transfer in at the end of the period. Previously the value of this business was included as the unadjusted IFRS net

asset value in the non-covered business which was consolidated in the Group MCEV.

In Latin America, the Group acquired a 51 percent stake in the insurance operations of Banco Santander S.A. in

Argentina, Brazil, Uruguay, Chile and Mexico. As part of the acquisition the Group also entered into a long-term

distribution agreement with Santander in Latin America. The end of period embedded value of the acquired life

business has also been included in the covered business for the first time and recorded as a transfer in at the end

of the period. Previously the value of this business was included in the non-covered business as the unadjusted

IFRS net asset value and consolidated in the Group MCEV.

The contribution to embedded value net of non-controlling interests from the ZIMB and the Zurich Santander

business as of December 31, 2012, was USD 1,160 million. The unadjusted IFRS net asset value of USD 1,422 million

corresponding to these businesses has been removed from the non-covered business reported in the Group MCEV

in section 11. The new business value of ZIMB and Zurich Santander has not been consolidated in the Global Life new

business value 2012 result. The new business value for the year ended December 31, 2012 for these businesses was

USD 195 million gross of non-controlling interests.

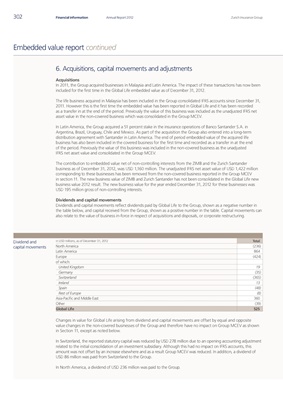

Dividends and capital movements

Dividends and capital movements reflect dividends paid by Global Life to the Group, shown as a negative number in

the table below, and capital received from the Group, shown as a positive number in the table. Capital movements can

also relate to the value of business in-force in respect of acquisitions and disposals, or corporate restructuring.

Dividend and in USD millions, as of December 31, 2012 Total

capital movements North America (236)

Latin America 864

Europe (424)

of which:

United Kingdom 19

Germany (35)

Switzerland (365)

Ireland 13

Spain (48)

Rest of Europe (8)

Asia-Pacific and Middle East 360

Other (39)

Global Life 525

Changes in value for Global Life arising from dividend and capital movements are offset by equal and opposite

value changes in the non-covered businesses of the Group and therefore have no impact on Group MCEV as shown

in Section 11, except as noted below.

In Switzerland, the reported statutory capital was reduced by USD 278 million due to an opening accounting adjustment

related to the initial consolidation of an investment subsidiary. Although this had no impact on IFRS accounts, this

amount was not offset by an increase elsewhere and as a result Group MCEV was reduced. In addition, a dividend of

USD 86 million was paid from Switzerland to the Group.

In North America, a dividend of USD 236 million was paid to the Group.