Zurich Insurance Group Annual Report 2012 Operating and financial review 93

Global Life

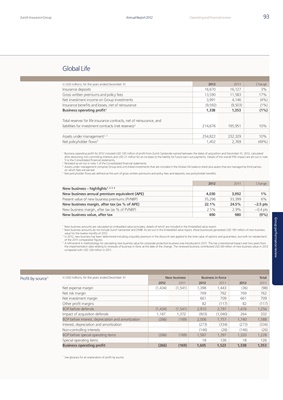

in USD millions, for the years ended December 31 2012 2011 Change

Insurance deposits 16,670 16,127 3%

Gross written premiums and policy fees 13,590 11,583 17%

Net investment income on Group investments 3,991 4,146 (4%)

Insurance benefits and losses, net of reinsurance (9,592) (9,503) (1%)

Business operating profit 1 1,338 1,353 (1%)

Total reserves for life insurance contracts, net of reinsurance, and

liabilities for investment contracts (net reserves) 2 214,676 195,951 10%

Assets under management 2, 3 254,822 232,329 10%

Net policyholder flows 4 1,402 2,769 (49%)

1

Business operating profit for 2012 included USD 105 million of profit from Zurich Santander earned between the dates of acquisition and December 31, 2012, calculated

after deducting non-controlling interests and USD 21 million for an increase to the liability for future earn-out payments. Details of the overall IFRS impact are set out in note

5 to the Consolidated financial statements.

2

Restated as set out in note 1 of the Consolidated financial statements.

3

Assets under management comprise Group and unit-linked investments that are included in the Global Life balance sheet plus assets that are managed by third parties,

on which fees are earned.

4

Net policyholder flows are defined as the sum of gross written premiums and policy fees and deposits, less policyholder benefits.

2012 2011 Change

New business – highlights 1, 2, 3, 4

New business annual premium equivalent (APE) 4,030 3,992 1%

Present value of new business premiums (PVNBP) 35,296 33,399 6%

New business margin, after tax (as % of APE) 22.1% 24.5% –2.5 pts

New business margin, after tax (as % of PVNBP) 2.5% 2.9% –0.4 pts

New business value, after tax 890 980 (9%)

Group performance review

1

New business amounts are calculated on embedded value principles, details of which are included in the Embedded value report.

2

New business amounts do not include Zurich Santander and ZIMB. As set out in the Embedded value report, these businesses generated USD 195 million of new business

value for the twelve months of 2012.

3

In 2012, new business has been determined including a liquidity premium in the discount rate applied to the time value of options and guarantees, but with no restatement

of the 2011 comparative figures.

4

A refinement in methodology for calculating new business value for corporate protection business was introduced in 2011. This has a transitional impact over two years from

the implementation date relating to renewals of business in-force at the date of the change. The renewed business contributed USD 68 million of new business value in 2012

compared with USD 126 million in 2011.

Profit by source 1 in USD millions, for the years ended December 31 New business Business in-force Total

2012 2011 2012 2011 2012 2011

Net expense margin (1,434) (1,541) 1,398 1,443 (36) (98)

Net risk margin 769 762 769 762

Net investment margin 661 709 661 709

Other profit margins 82 (117) 82 (117)

BOP before deferrals (1,434) (1,541) 2,910 2,797 1,476 1,256

Impact of acquisition deferrals 1,167 1,372 (903) (1,040) 264 332

BOP before interest, depreciation and amortization (266) (169) 2,006 1,757 1,740 1,588

Interest, depreciation and amortization (273) (334) (273) (334)

Non-controlling interests (146) (26) (146) (26)

BOP before special operating items (266) (169) 1,587 1,397 1,320 1,228

Special operating items 18 126 18 126

Business operating profit (266) (169) 1,605 1,523 1,338 1,353

1

See glossary for an explanation of profit by source.