11

2%

4%

2%

-12%

-13%

-6%

22 33

-6%

-3%

-5%

-9%

-12%

-13% -14%

-11%

-16%

-11%

Housing market

closed 23 March

to 13 May

Over 2020, as a whole, the increase in supply outpaced demand. This

imbalance created a surplus of rental stock, causing average rents to fall.

Over the year as a whole, average rents fell by 6%, from £435 p/w to

£409 p/w, an annual reduction of £1348 in landlords' income.

Income prioritised

The greatest fall in rents occurred during

the first lockdown of 2020 when the housing

market closed and landlords accepted lower

offers rather than risk voids. The oversupply

of homes to rent, particularly in more

central areas, remained, and most private

landlords prioritise income over headline

rents on the understanding that the rent

can be reviewed within a year and that

when the market rebalances, income will

recover. At that time, many commentators

were likening the economic shock of

Covid to the Global Financial Crisis of

2008 and there was a great deal of fear

for the future. In practice, the Chancellor

acted quickly to protect businesses and

jobs and now there is a widely held belief

that we can expect a strong bounce-back

when hospitality and retail reopen.

While rents did recover to some extent

when the market reopened in summer

2020, properties began to stay on the

market longer when the usual influx of

students didn't materialise and with

renewed restrictions over the autumn.

This trend continued throughout the first

few months of 2021 and the impact on

rents is most evident when comparing

March 2020 on March 2021, where we

saw a drop across London of 11%. Average rents fell across all areas

during the pandemic but the

severity of the fall varied between

each London zone.

ZONE 1 experienced the largest annual

decline in rents in 2020 since the Global

Financial Crisis, at 11.4%, from £550 p/w

to £487. With a 22% fall in renters per

instruction, it was no surprise that Zone 1

suffered the most. Demand for 1 bed

WHAT NEXT

FOR RENTS?

Jan

£490

£480

£460

£470

£450

£410

£420

£430

£440

Feb Mar Apr May Jun

2020/2021

AVERAGE

WEEKLY RENT

£459 £405

£481 £406

£465 £436

LOCKDOWN

The biggest drop in annual rents was seen in

February 2021. This fall was exaggerated as

rents in February 2020 had increased by 4%,

following a decisive general election and the

UK commitment to withdrawal from the EU.

8.6% FALL IN RENTS

Foxtons

Foxtons

The imbalance between

supply and demand put

downward pressure on

rents, causing average

weekly rents in London

to fall by 8.6%.

46.3%

22.0%

New instructions

Renter

registrations

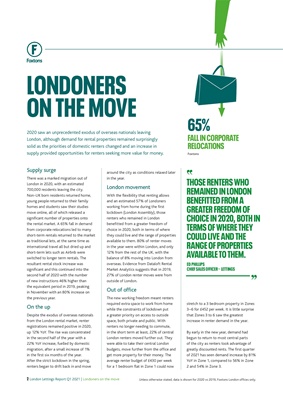

ANNUAL CHANGE IN RENTS

EVERY ZONE TELLS A STORY

March 2021 vs March 2020

H2 2020 vs H2 2019

ZONE 1 ZONE 2 ZONE 3

-20.5% -4.3%

--99..22%%

2020 vs 2019

H2 2020 vs H2 2019

Unless otherwise stated, data is shown for 2020 vs 2019, Foxtons London offices only.

4 London Lettings Report Q1 2021 | What next for rents?

£400

Housing market remains open

Eat Out to

Help Out

scheme started

Tier system

introduced

Map out of

lockdown

announced

Student

migration

interrupted

Schools

return

properties fell by 7% and 2 beds by 10%.

The imbalance between supply and demand

was accentuated by the profile of renters in

the Zone 1 market; large volumes of students,

corporate and short-term lets, as well as a

high proportion of international renters.

Gen Y moved in to plug some of the

shortfall, but only if rents were discounted.

ZONE 2 rents declined by a more modest

6.1%, moving from £460 p/w to £432. The

fall was stemmed by an increase in demand

of 4.2% for 1 bed properties and 1.9% for

2 bed properties. That increase in demand

helped to support average rents in Zone 2.

ZONE 3-6 experienced only a very

small decline in rents of 2.4%, from

£391 p/w to £382. Rents were held up

by renters taking their central London

budgets further out, searching for more

space to work from home and outside

space. This resulted in renters per

instruction increasing by 11.6% in

these parts of the city.

WHAT IS THE PROGNOSIS

FOR RECOVERY?

The London rental market recovery will be

closely linked to the return of international

migration, students, business travel and

the workforce. As long as London remains

a highly attractive global city in which

to live and work, we expect international

migration to return. In a survey of over

200,000 global workers, Boston Consulting

Group and Totaljobs found that London

remained the most attractive global city

to both live and work. Other surveys

show that professionals miss the office

environment, with 54% of office

workers wanting to return 1 or 2 days

per week, and 25% wanting to return

3 or 4 days per week (Stanton House).

Pre-pandemic there were concerns about

London's pre-eminent status as a global

financial centre when the UK left the EU.

Those fears have been overshadowed by

more immediate threats but financial

services sentiment continued to pick up

in the last quarter of 2020 and business

volumes returned to growth for the first

time in over two years (PwC/CBI Financial

Services Survey). Although this survey

pre-dated the third national lockdown,

it reflects the underlying resilience of

London's economy. The roadmap out of

lockdown suggests all social distancing

will be lifted from 21st June 2021 and

the UK economy is expected to return

to pre-pandemic levels by mid-2022.

Rental markets tend to react fast to

fluctuations in the supply-demand

balance because both landlords and

renters are making short-term decisions

which can be revised. For that reason,

rents can quickly move downwards in a

weak market and recover just as quickly

once the market recovers. We expect

the current imbalance to begin to correct

itself as soon as the economy reopens.

5%

-5%

-15%

0%

-10%

-20%

Jan Feb Mar

Jun Jul Aug Sep Oct Nov Dec

YEAR ON

YEAR WEEKLY

CHANGE IN

RENT

£445 £417 £408

£443 £406 £405

£443

£436 £403 £414

LOCKDOWN LOCKDOWN

Unless otherwise stated, data is shown for 2020 vs 2019, Foxtons London offices only. London Lettings Report Q1 2021 | What next for rents? 5