LET

SOLD

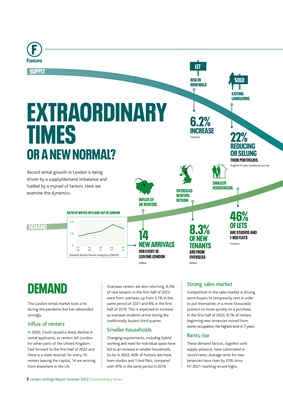

Record rental growth in London is being

driven by a supply/demand imbalance and

fuelled by a myriad of factors. Here we

examine the dynamics.

The London rental market took a hit

during the pandemic but has rebounded

strongly.

Influx of renters

In 2020, Covid caused a sharp decline in

rental applicants, as renters left London

for other parts of the United Kingdom.

Fast forward to the first half of 2022 and

there is a stark reversal: for every 10

renters leaving the capital, 14 are arriving

from elsewhere in the UK.

Overseas renters are also returning. 8.3%

of new tenants in the first half of 2022

were from overseas, up from 5.1% in the

same period of 2021 and 8% in the first

half of 2019. This is expected to increase

as overseas students arrive during the

traditionally busiest third quarter.

Smaller households

Changing requirements, including hybrid

working and need for individual space have

led to an increase in smaller households.

So far in 2022, 46% of Foxtons lets have

been studios and 1-bed flats, compared

with 41% in the same period in 2019.

Strong sales market

Competition in the sales market is driving

some buyers to temporarily rent in order

to put themselves in a more favourable

position to move quickly on a purchase.

In the first half of 2022, 8.1% of renters

beginning new tenancies moved from

owner occupation, the highest level in 7 years.

Rents rise

These demand factors, together with

supply pressure, have culminated in

record rents. Average rents for new

tenancies have risen by 25% since

H1 2021 reaching record highs.

DEMAND

SUPPLY

DEMAND

2 London Lettings Report Summer 2022 | Extraordinary times

RISE IN

RENEWALS

INFLUX OF

UK RENTERS

OVERSEAS

RENTERS

RETURN

EXITING

LANDLORDS

SMALLER

HOUSEHOLDS

EXTRAORDINARY

TIMES

OR A NEW NORMAL?

6.2% INCREASE

14 NEW ARRIVALS

FOR EVERY 10

LEAVING LONDON

8.3% OF NEW

TENANTS

ARE FROM

OVERSEAS

22% REDUCING

OR SELLING

THEIR PORTFOLIOS

46% OF LETS

ARE STUDIOS AND

1-BED FLATS

2.0

1.0

0 H1

20

H1

22

H2

20

H1

21

H2

21

RATIO OF MOVES INTO AND OUT OF LONDON

Dataloft Rental Market Analytics (DRMA)

DRMA

DRMA

Foxtons

Foxtons

English Private Landlords Survey