2

WHILE SOME LANDLORDS

ARE BEING DETERRED BY

INCREASED LEGISLATION

AND COSTS, THOSE WHO

REMAIN CONTINUE TO

SEE GOOD INCOME

RETURNS.

London Lettings Report Summer 2022 | Affordability 5

£14,314

B-T-L MORTGAGE RATE OF

6.9%

NET ANNUAL INCOME

FOR LANDLORDS

WITH 2-BED FLATS

AFTER MORTGAGE INTEREST PAYMENTS

OR BELOW FOR

LANDLORDS TO PROFIT

LANDLORDS WITH A 2-BED FLAT BASED ON

CURRENT RENTS AND SALES PRICES

Dataloft Rental Market Analytics, ONS, Land Registry,

Bank of England/FCA (mortgage payments assume a

75% LTV interest-only mortgage)

Foxtons, DRMA

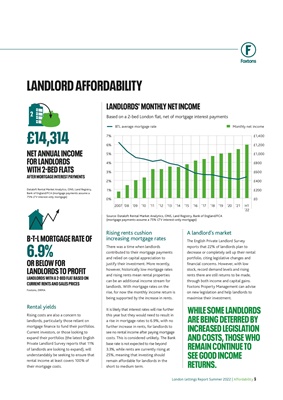

LANDLORDS' MONTHLY NET INCOME

Rental yields

Rising costs are also a concern to

landlords, particularly those reliant on

mortgage finance to fund their portfolios.

Current investors, or those looking to

expand their portfolios (the latest English

Private Landlord Survey reports that 11%

of landlords are looking to expand), will

understandably be seeking to ensure that

rental income at least covers 100% of

their mortgage costs.

Rising rents cushion

increasing mortgage rates

There was a time when landlords

contributed to their mortgage payments

and relied on capital appreciation to

justify their investment. More recently,

however, historically low mortgage rates

and rising rents mean rental properties

can be an additional income stream for

landlords. With mortgage rates on the

rise, for now the monthly income return is

being supported by the increase in rents.

It is likely that interest rates will rise further

this year but they would need to result in

a rise in mortgage rates to 6.9%, with no

further increase in rents, for landlords to

see no rental income after paying mortgage

costs. This is considered unlikely. The Bank

base rate is not expected to rise beyond

3.3%, while rents are currently rising at

25%, meaning that investing should

remain affordable for landlords in the

short to medium term.

A landlord's market

The English Private Landlord Survey

reports that 22% of landlords plan to

decrease or completely sell up their rental

portfolio, citing legislative changes and

financial concerns. However, with low

stock, record demand levels and rising

rents there are still returns to be made,

through both income and capital gains.

Foxtons Property Management can advise

on new legislation and help landlords to

maximise their investment.

LANDLORD AFFORDABILITY

Source: Dataloft Rental Market Analytics, ONS, Land Registry, Bank of England/FCA

(mortgage payments assume a 75% LTV interest-only mortgage)

£800

4%

£1,000

5%

£1,200

6%

£1,400

7%

£400

2%

£600

3%

£200

1%

£0

0%

Monthly net income

BTL average mortgage rate

2007 '08 '09 '10 '11 '12 '13 '14 '15 '16 '19

'17 '20

'18 '21 H1

'22

Based on a 2-bed London flat, net of mortgage interest payments