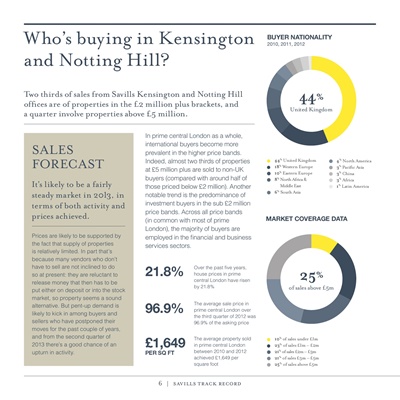

Who’s buying in Kensington BuYer nationalitY

2010, 2011, 2012

and Notting Hill?

Two thirds of sales from Savills Kensington and Notting Hill

offices are of properties in the £2 million plus brackets, and

44%

United Kingdom

a quarter involve properties above £5 million.

In prime central London as a whole,

international buyers become more

sAlEs prevalent in the higher price bands.

fORECAsT Indeed, almost two thirds of properties

at £5 million plus are sold to non-UK

44% United Kingdom

18% Western Europe

10% Eastern Europe

4% North america

3% Pacific asia

3% China

buyers (compared with around half of 8% North africa & 3% africa

It’s likely to be a fairly those priced below £2 million). Another Middle East 1% Latin america

6% South asia

steady market in 2013, in notable trend is the predominance of

terms of both activity and investment buyers in the sub £2 million

price bands. Across all price bands

prices achieved. (in common with most of prime marKet coverage data

London), the majority of buyers are

Prices are likely to be supported by employed in the financial and business

the fact that supply of properties services sectors.

is relatively limited. In part that’s

because many vendors who don’t

21.8%

have to sell are not inclined to do Over the past five years,

so at present: they are reluctant to

release money that then has to be

house prices in prime

central London have risen 25%

by 21.8% of sales above £5m

put either on deposit or into the stock

market, so property seems a sound

96.9%

alternative. But pent-up demand is The average sale price in

prime central London over

likely to kick in among buyers and the third quarter of 2012 was

sellers who have postponed their 96.9% of the asking price

moves for the past couple of years,

and from the second quarter of

£1,649

The average property sold 10% of sales under £1m

2013 there’s a good chance of an in prime central London 23% of sales £1m – £2m

upturn in activity. per SQ ft between 2010 and 2012 21% of sales £2m – £3m

achieved £1,649 per 21% of sales £3m – £5m

square foot 25% of sales above £5m

6 | savills track record