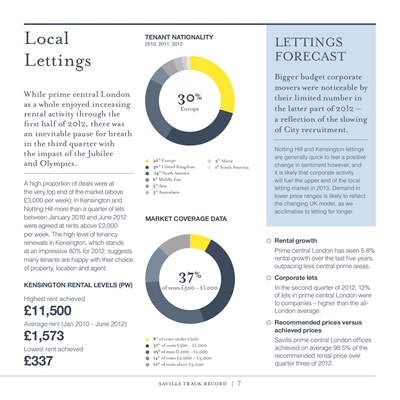

Local tenant nationalitY

2010, 2011, 2012 lETTINGs

Lettings fORECAsT

Bigger budget corporate

movers were noticeable by

While prime central London

as a whole enjoyed increasing

30% their limited number in

Europe the latter part of 2012 –

rental activity through the

a reflection of the slowing

first half of 2012, there was

an inevitable pause for breath of City recruitment.

in the third quarter with

Notting Hill and Kensington lettings

the impact of the Jubilee are generally quick to feel a positive

30 Europe

%

2 africa

%

and Olympics. 30% United Kingdom 1% South america change in sentiment however, and

24% North america it is likely that corporate activity

6% Middle East will fuel the upper end of the local

A high proportion of deals were at 5% asia

letting market in 2013. Demand in

the very top end of the market (above 3% australasia

lower price ranges is likely to reflect

£3,000 per week); in Kensington and the changing UK model, as we

Notting Hill more than a quarter of lets acclimatise to letting for longer.

between January 2010 and June 2012 marKet coverage data

were agreed at rents above £2,000

per week. The high level of tenancy

renewals in Kensington, which stands rental growth

at an impressive 80% for 2012, suggests Prime central London has seen 5.8%

many tenants are happy with their choice rental growth over the last five years,

of property, location and agent. outpacing less central prime areas.

KenSington rental levelS (pW)

37% corporate lets

of rents £500 – £1,000 In the second quarter of 2012, 12%

of lets in prime central London were

Highest rent achieved

to companies – higher than the all-

£11,500 London average.

Average rent (Jan 2010 – June 2012) recommended prices versus

achieved prices

£1,573 8% of rents under £500

37% of rents £500 – £1,000

Savills prime central London offices

Lowest rent achieved 29% of rents £1,000 – £2,000

achieved on average 98.5% of the

recommended rental price over

£337 14% of rents £2,000 – £3,000

12% of rents above £3,000 quarter three of 2012.

savills track record | 7