Over 2019 Foxtons

registered 12% more

renters than in 2018.

As stock levels struggled

to meet the rising levels

of demand, the ratio of

new tenants registering

to new properties

instructed was

consistently above

average throughout

the year.

Areas shaded grey

did not have

enough data points

for the period

THE LONDON LETTINGS REPORT QUARTERLY

London

Q1-4 2019

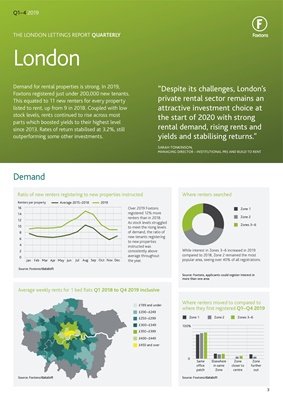

Ratio of new renters registering to new properties instructed

Average weekly rents for 1 bed flats Q1 2018 to Q4 2019 inclusive

12

16

14

Average 2015-2018

Renters per property 2019

Source: Foxtons/dataloft

10

8

6

2

4

0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

£199 and under

£200-£249

£250-£299

£300-£349

£350-£399

£400-£449

£450 and over

Source: Foxtons/dataloft

Demand for rental properties is strong. In 2019,

Foxtons registered just under 200,000 new tenants.

This equated to 11 new renters for every property

listed to rent, up from 9 in 2018. Coupled with low

stock levels, rents continued to rise across most

parts which boosted yields to their highest level

since 2013. Rates of return stabilised at 3.2%, still

outperforming some other investments.

"Despite its challenges, London's

private rental sector remains an

attractive investment choice at

the start of 2020 with strong

rental demand, rising rents and

yields and stabilising returns."

SARAH TONKINSON,

MANAGING DIRECTOR - INSTITUTIONAL PRS AND BUILD TO RENT

Where renters searched

Where renters moved to compared to

where they first registered Q1-Q4 2019

Zone 1

Zone 1

Zone 2

Zone 2

Zones 3-6

Zones 3-6

While interest in Zones 3-6 increased in 2019

compared to 2018, Zone 2 remained the most

popular area, seeing over 40% of all registrations.

Source: Foxtons, applicants could register interest in

more than one area

100%

Source: Foxtons/dataloft

0

Same

office

patch

Elsewhere

in same

Zone

Zone

closer to

centre

Zone

further

out

Demand

3