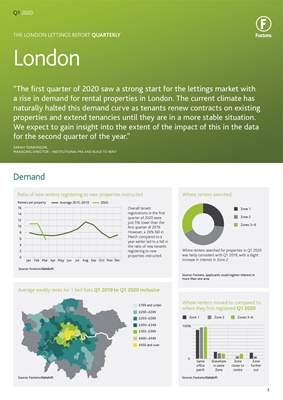

Compared to Q1 2019,

average rents in

Q1 2020 were higher

across most parts of

London, with strongest

growth in Zone 2.

£463

2.5%

Annual change

Weekly rent

Average weekly rent in London

Q1 2020

Change in average rents between

Q1 2019 and Q1 2020

Source: Foxtons/dataloft

All properties

5

£287 £395

£490 £681

-3.2% 6.2%

6.5% -1.7%

Annual change in average weekly rents Q1 2019 to Q1 2020

Average price per square foot in London

Average annual £psf for tenancies (long let)

Average £psf for sales exchanged

Rental premium /

discount by floor level

Source: Foxtons/dataloft

Source: Foxtons/dataloft

Zone 1 Zone 2 Zones 3-6 All London

5%

Average rents and annual change by property type

Average weekly rent

annual % change Q1 2019 to Q1 2020

Raised ground floor flats continued to achieve the

highest premiums in Q1 2020.

Source: Foxtons/dataloft, showing the rental premium/

discount paid per square foot compared to the overall

average rent per square foot for flats in Q1 2020.

1 bed flat

2 bed flat 3+ bed flat

THE LONDON LETTINGS REPORT QUARTERLY

Rental values

Average rents in the first quarter of the year continued to rise,

with one and two bed flats performing most strongly. Properties

in London's Zone 2 experienced the strongest growth, with

Zone 1 not far behind. 123+

£51.93

£967

£39.90

£728

£33.32

£715

£31.14

£685

£25.13

£518

Studio 1 bed flat 2 bed flat 3+ bed flat House

Rents

Sales

Lower ground

Ground

Raised ground

First floor and higher 3.0%

9.2%

-10.5%

5.7%

-2%

Studio

4

THE LONDON LETTINGS REPORT QUARTERLY

Supply / rents annual change

Throughout the first quarter, the number of properties available to

rent was lower than a year earlier. That said, new instructions rose

in March compared to March 2019, as landlords switched from

shorter term rentals and some tenants chose to end their tenancies.

This should be reflected in the availability figure next quarter.

-5%

21%

Annual change in rents and stock

Available stock / average rents Quarterly

Available stock / average rents

Source: Foxtons/dataloft

Source: Foxtons/dataloft

Chart shows the year-on-year change in both the number of properties available to rent (in the last month of the quarter,

i.e. Q1 2020 shows stock at the beginning of March) and the average price of properties let in the quarter.

30%

20%

10%

0%

-10%

-20%

-30% Available stock

Available stock

Average rental price

Average rental price

Jan 2016

Feb 2016

Mar 2016

Apr 2016

May 2016

Jun 2016

Jul 2106

Aug 2016

Sep 2016

Oct 2016

Nov 2016

Dec 2016

Jan 2017

Feb 2017

Mar 2017

Apr 2017

May 2017

Jun 2017

Jul 2017

Aug 2017

Sep 2017

Oct 2017

Nov 2017

Dec 2017

Jan 2018

Feb 2018

Mar 2018

Apr 2018

May 2018

Jun 2018

Jul 2018

Aug 2018

Sep 2018

Oct 2018

Nov 2018

Dec 2018

Jan 2019

Feb 2019

Mar 2019

Apr 2019

May 2019

June 2019

Jul 2019

Aug 2019

Sep 2019

Oct 2019

Nov 2019

Dec 2019

Jan 2020

Feb 2020

Mar 2020

-30% -30% -30%

30% 30% 30%

20% 20% 20%

10% 10% 10%

0% 0% 0%

-10% -10% -10%

-20% -20% -20%

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Annual change

Zone 1 Zone 2 Zones 3-6

Q1 2020

With a 21% increase in

new instructions in

March 2020 compared

to March 2019, it is likely

that the rate of decline in

availability will ease in

the second quarter.

Decrease in demand

Q1 2020 compared to Q1 2019

Increase in new instructions in

March 2020 compared to March 2019

Q1 2020