£

£

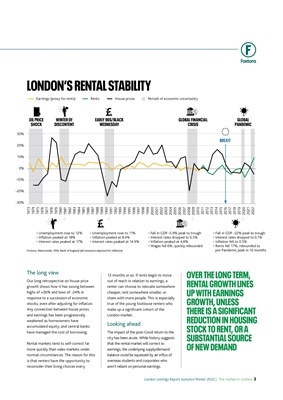

The long view

Our long retrospective on house price

growth shows how it has swung between

highs of +26% and lows of -24% in

response to a succession of economic

shocks, even after adjusting for inflation.

Any connection between house prices

and earnings has been progressively

weakened as homeowners have

accumulated equity, and central banks

have managed the cost of borrowing.

Rental markets tend to self-correct far

more quickly than sales markets under

normal circumstances. The reason for this

is that renters have the opportunity to

reconsider their living choices every

12 months or so. If rents begin to move

out of reach in relation to earnings, a

renter can choose to relocate somewhere

cheaper, rent somewhere smaller, or

share with more people. This is especially

true of the young footloose renters who

make up a significant cohort of the

London market.

Looking ahead

The impact of the post-Covid return to the

city has been acute. While history suggests

that the rental market will correct to

earnings, the underlying supply/demand

balance could be squeezed by an influx of

overseas students and corporates who

aren't reliant on personal earnings.

London Lettings Report Autumn/Winter 2022 | The market in context 3

LONDON'S RENTAL STABILITY

0%

10%

20%

30%

-20%

-10%

-30%

Periods of economic uncertainty

Rents House prices

Earnings (proxy for rents)

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

OIL PRICE

SHOCK

WINTER OF

DISCONTENT

EARLY 90S/BLACK

WEDNESDAY

GLOBAL FINANCIAL

CRISIS

BREXIT

GLOBAL

PANDEMIC

• Unemployment rose to 12%

• Inflation peaked at 18%

• Interest rates peaked at 17%

• Unemployment rose to 11%

• Inflation peaked at 8.4%

• Interest rates peaked at 14.9%

• Fall in GDP -5.9% peak to trough

• Interest rates dropped to 0.5%

• Inflation peaked at 4.8%

• Wages fell 6%, quickly rebounded

• Fall in GDP -22% peak to trough

• Interest rates dropped to 0.1%

• Inflation fell to 0.5%

• Rents fell 17%, rebounded to

pre-Pandemic peak in 10 months

Foxtons, Nationwide, ONS, Bank of England (all measures adjusted for inflation)

OVER THE LONG TERM,

RENTAL GROWTH LINES

UP WITH EARNINGS

GROWTH, UNLESS

THERE IS A SIGNIFICANT

REDUCTION IN HOUSING

STOCK TO RENT, OR A

SUBSTANTIAL SOURCE

OF NEW DEMAND