8

TO ADVERTISE IN THE PURLEY PAGES CALL : 0208 773 4737

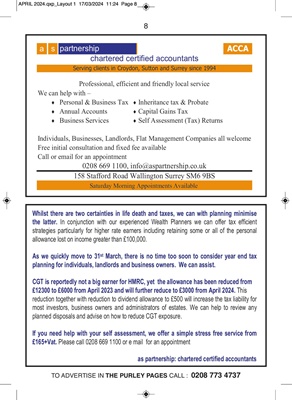

as ACCA

We can help with -

♦ Personal & Business Tax ♦ Inheritance tax & Probate

♦ Annual Accounts ♦ Capital Gains Tax

♦ Business Services ♦ Self Assessment (Tax) Returns

Individuals, Businesses, Landlords, Flat Management Companies all welcome

Free initial consultation and fixed fee available

Call or email for an appointment

Professional, efficient and friendly local service

partnership

0208 669 1100, info@aspartnership.co.uk

158 Stafford Road Wallington Surrey SM6 9BS

Saturday Morning Appointments Available

Serving clients in Croydon, Sutton and Surrey since 1994

chartered certified accountants

Whilst there are two certainties in life death and taxes, we can with planning minimise

the latter. In conjunction with our experienced Wealth Planners we can offer tax efficient

strategies particularly for higher rate earners including retaining some or all of the personal

allowance lost on income greater than ¢100,000.

As we quickly move to 31st March, there is no time too soon to consider year end tax

planning for individuals, landlords and business owners. We can assist.

CGT is reportedly not a big earner for HMRC, yet the allowance has been reduced from

¢12300 to ¢6000 from April 2023 and will further reduce to ¢3000 from April 2024. This

reduction together with reduction to dividend allowance to ¢500 will increase the tax liability for

most investors, business owners and administrators of estates. We can help to review any

planned disposals and advise on how to reduce CGT exposure.

If you need help with your self assessment, we offer a simple stress free service from

¢165+Vat. Please call 0208 669 1100 or e mail for an appointment

as partnership: chartered certified accountants

APRIL 2024.qxp_Layout 1 17/03/2024 11:24 Page 8