PCL: a unique opportunity

The Prime Central London market has always

offered unique opportunities to those willing

and able to invest. As the PCL market can be

more sensitive to political and financial

uncertainty, a deep understanding of its nuances

is essential. The 2019 market, as a result of

Brexit uncertainty, saw best-in-class and

best-in-price properties in strong demand, with

buyers benefitting from sellers adjusting prices

where needed.

Towards the end of the year, financial and

business service sector confidence began to

improve (PwC/CBI Financial Services Survey) and

the sterling strengthened. Accidental landlords

started putting properties back on the market

and, as a result, Foxtons exchanged 26% more

properties in Prime Central London in the second

half of the year compared to the first.

Demand for rental properties across Prime

Central London continued to build over 2019,

while the low levels of stock in the market

supported rental growth. Due to the uncertainty

in the sales market, many would-be buyers

decided to rent instead, and we saw an increase

in those looking to rent with an option of buying.

In line with this increased rental demand, rents

rose strongly, particularly for smaller properties.

In particular, we let 8% more studios in 2019

than in 2018 at a 5.3% higher level of rent.

Matching people and homes

Overseas buyers arriving in London for the first

time often have fixed preconceptions about

where they want to live - perhaps somewhere

recommended by a friend, or an area they know

from a film. But in reality, the property they

want, or can afford, might not be available there.

Building typology is a big factor in moving

people around London. Each Prime Central

London village has its own distinct character and

often an architectural vernacular dating back to

its Great Estate heritage. A buyer accustomed

to lateral living can struggle to adapt to life in

a tall, narrow Georgian or Regency townhouse.

They might begin their search in Knightsbridge

or Belgravia but end up in Holland Park,

Hampstead or Notting Hill. A few years ago,

plenty of homes in Knightsbridge sold for £2-3m

but today, £10m is closer to the norm; price

differentials open the mind to more areas too.

BY PRICE, 2019 SALES

BY £PSF, 2019 SALES

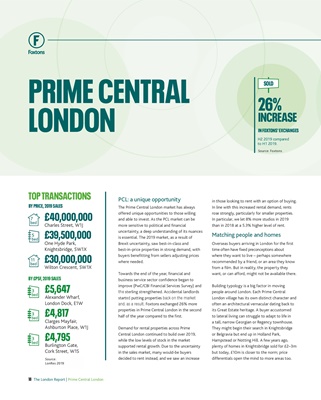

26%

INCREASE

IN FOXTONS' EXCHANGES

H2 2019 compared

to H1 2019.

£40,000,000Charles Street, W1J

£39,500,000One Hyde Park,

Knightsbridge, SW1X

£30,000,000Wilton Crescent, SW1X

£5,647Alexander Wharf,

London Dock, E1W

£4,817Clarges Mayfair,

Ashburton Place, W1J

£4,795Burlington Gate,

Cork Street, W1S

TOP TRANSACTIONS

7

bed

5

bed

3

bed

3

bed

3

bed

11

bed

LonRes 2019

PRIME CENTRAL

LONDON

SOLD

Source: Foxtons

Source:

LonRes 2019

18 The London Report | Prime Central London