TRUSTEES' REPORT AND ACCOUNTS 2014 21

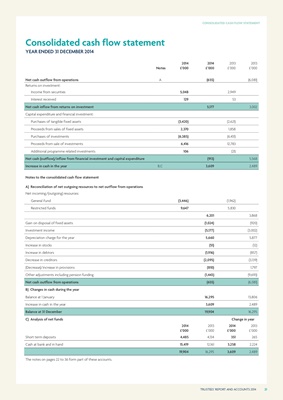

Consolidated cash flow statement

YEAR ENDED 31 DECEMBER 2014

Notes

2014

£'000

2014

£'000

2013

£'000

2013

£'000

Net cash outflow from operations A (655) (6,081)

Returns on investment:

Income from securities 5,048 2,949

Interest received 129 53

Net cash inflow from returns on investment 5,177 3,002

Capital expenditure and financial investment:

Purchases of tangible fixed assets (3,420) (2,621)

Proceeds from sales of fixed assets 2,370 1,858

Purchases of investments (6,385) (6,431)

Proceeds from sale of investments 6,416 12,783

Additional programme related investments 106 (21)

Net cash (outflow)/inflow from financial investment and capital expenditure (913) 5,568

Increase in cash in the year B,C 3,609 2,489

Notes to the consolidated cash flow statement

A) Reconciliation of net outgoing resources to net outflow from operations

Net incoming/(outgoing) resources:

General Fund (3,446) (1,962)

Restricted funds 9,647 5,830

6,201 3,868

Gain on disposal of fixed assets (1,024) (920)

Investment income (5,177) (3,002)

Depreciation charge for the year 5,660 5,877

Increase in stocks (51) (12)

Increase in debtors (1,916) (857)

Decrease in creditors (2,095) (3,139)

(Decrease)/increase in provisions (810) 1,797

Other adjustments including pension funding (1,443) (9,693)

Net cash outflow from operations (655) (6,081)

B) Changes in cash during the year

Balance at 1 January 16,295 13,806

Increase in cash in the year 3,609 2,489

Balance at 31 December 19,904 16,295

C) Analysis of net funds Change in year

2014

£'000

2013

£'000

2014

£'000

2013

£'000

Short term deposits 4,485 4,134 351 265

Cash at bank and in hand 15,419 12,161 3,258 2,224

19,904 16,295 3,609 2,489

The notes on pages 22 to 36 form part of these accounts.

CONSOLIDATED CASH FLOW STATEMENT