TRUSTEES' REPORT AND ACCOUNTS 2014 35

20 PENSIONS (CONTINUED)

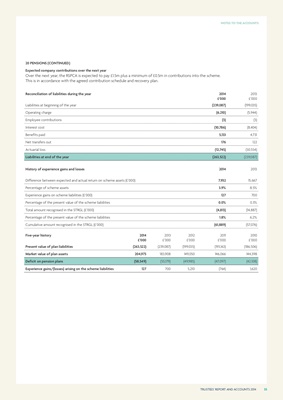

Expected company contributions over the next year

Over the next year, the RSPCA is expected to pay £1.5m plus a minimum of £0.5m in contributions into the scheme.

This is in accordance with the agreed contribution schedule and recovery plan.

Reconciliation of liabilities during the year 2014

£'000

2013

£'000

Liabilities at beginning of the year (239,087) (199,035)

Operating charge (6,210) (5,944)

Employee contributions (3) (3)

Interest cost (10,786) (8,404)

Benefits paid 5,133 4,731

Net transfers out 176 122

Actuarial loss (12,745) (30,554)

Liabilities at end of the year (263,522) (239,087)

History of experience gains and losses 2014 2013

Difference between expected and actual return on scheme assets (£'000) 7,932 15,667

Percentage of scheme assets 3.9% 8.5%

Experience gains on scheme liabilities (£'000) 127 700

Percentage of the present value of the scheme liabilities 0.0% 0.3%

Total amount recognised in the STRGL (£'000) (4,813) (14,887)

Percentage of the present value of the scheme liabilities 1.8% 6.2%

Cumulative amount recognised in the STRGL (£'000) (61,889) (57,076)

Five-year history 2014

£'000

2013

£'000

2012

£'000

2011

£'000

2010

£'000

Present value of plan liabilities (263,522) (239,087) (199,035) (193,163) (186,506)

Market value of plan assets 204,973 183,908 149,050 146,066 144,398

Deficit on pension plans (58,549) (55,179) (49,985) (47,097) (42,108)

Experience gains/(losses) arising on the scheme liabilities 127 700 5,210 (764) 1,620

NOTES TO THE ACCOUNTS