TRUSTEES' REPORT AND ACCOUNTS 2014

28

NOTES TO THE ACCOUNTS

Notes to the accounts (continued)

YEAR ENDED 31 DECEMBER 2014

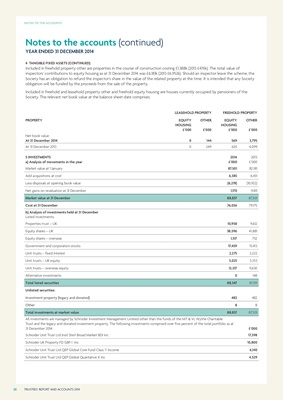

4 TANGIBLE FIXED ASSETS (CONTINUED)

Included in freehold property other are properties in the course of construction costing £1,388k (2013 £476k). The total value of

inspectors' contributions to equity housing as at 31 December 2014 was £6,181k (2013 £6,952k). Should an inspector leave the scheme, the

Society has an obligation to refund the inspector's share in the value of the related property at the time. It is intended that any Society

obligation will be funded by the proceeds from the sale of the property.

Included in freehold and leasehold property other and freehold equity housing are houses currently occupied by pensioners of the

Society. The relevant net book value at the balance sheet date comprises:

LEASEHOLD PROPERTY FREEHOLD PROPERTY

PROPERTY EQUITY

HOUSING

£'000

OTHER

£'000

EQUITY

HOUSING

£'000

OTHER

£'000

Net book value

At 31 December 2014 0 144 569 3,795

At 31 December 2013 0 249 620 4,099

5 INVESTMENTS

a) Analysis of movements in the year

2014

£'000

2013

£'000

Market value at 1 January 87,501 82,181

Add acquisitions at cost 6,385 6,431

Less disposals at opening book value (6,219) (10,922)

Net gains on revaluation at 31 December 1,170 9.811

Market value at 31 December 88,837 87,501

Cost at 31 December 76,036 79,175

b) Analysis of investments held at 31 December

Listed investments:

Properties trust - UK 10,958 9,612

Equity shares - UK 38,596 41,881

Equity shares - overseas 1,517 752

Government and corporation stocks 17,459 15,413

Unit trusts - fixed interest 2,275 2,222

Unit trusts - UK equity 5,025 5,353

Unit trusts - overseas equity 12,517 11,630

Alternative investments 0 148

Total listed securities 88,347 87,011

Unlisted securities:

Investment property (legacy and donated) 482 482

Other 8 8

Total investments at market value 88,837 87,501

All investments are managed by Schroder Investment Management Limited other than the funds of the MT & VL Wythe Charitable

Trust and the legacy and donated investment property. The following investments comprised over five percent of the total portfolio as at

31 December 2014: £'000

Schroder Unit Trust Ltd Instl Sterl Broad Market BDI Inc 17,398

Schroder UK Property FD GBP I Inc 10,800

Schroder Unit Trust Ltd QEP Global Core Fund Class 'I' Income 6,140

Schroder Unit Trust Ltd QEP Global Quantative X Inc 4,529