TRUSTEES' REPORT AND ACCOUNTS 2014 33

20 PENSIONS (CONTINUED)

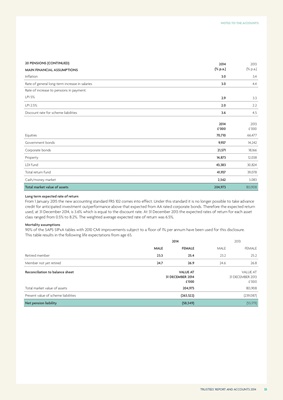

MAIN FINANCIAL ASSUMPTIONS

2014

(% p.a.)

2013

(% p.a.)

Inflation 3.0 3.4

Rate of general long-term increase in salaries 3.0 4.4

Rate of increase to pensions in payment:

LPI 5% 2.9 3.3

LPI 2.5% 2.0 2.2

Discount rate for scheme liabilities 3.6 4.5

2014

£'000

2013

£'000

Equities 70,710 66,477

Government bonds 9,937 14,242

Corporate bonds 21,571 18,166

Property 14,873 12,038

LDI fund 43,383 30,824

Total return fund 41,937 39,078

Cash/money market 2,562 3,083

Total market value of assets 204,973 183,908

Long term expected rate of return

From 1 January 2015 the new accounting standard FRS 102 comes into effect. Under this standard it is no longer possible to take advance

credit for anticipated investment outperformance above that expected from AA rated corporate bonds. Therefore the expected return

used, at 31 December 2014, is 3.6% which is equal to the discount rate. At 31 December 2013 the expected rates of return for each asset

class ranged from 0.5% to 8.2%. The weighted average expected rate of return was 6.5%.

Mortality assumptions

90% of the SAPS S1PxA tables with 2010 CMI improvements subject to a floor of 1% per annum have been used for this disclosure.

This table results in the following life expectations from age 65.

2014 2013

MALE FEMALE MALE FEMALE

Retired member 23.3 25.4 23.2 25.2

Member not yet retired 24.7 26.9 24.6 26.8

Reconciliation to balance sheet VALUE AT

31 DECEMBER 2014

£'000

VALUE AT

31 DECEMBER 2013

£'000

Total market value of assets 204,973 183,908

Present value of scheme liabilities (263,522) (239,087)

Net pension liability (58,549) (55,179)

NOTES TO THE ACCOUNTS