30 Employee retirement benefit obligations continued

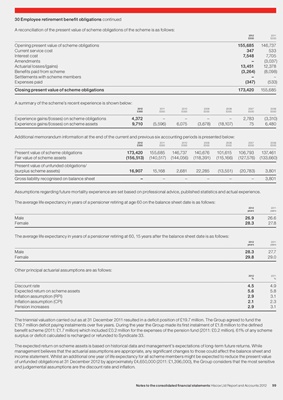

A reconciliation of the present value of scheme obligations of the scheme is as follows:

2012 2011

£000 £000

Opening present value of scheme obligations 155,685 146,737

Current service cost 347 533

Interest cost 7,548 7,705

Amendments – (3,037)

Actuarial losses/(gains) 13,451 12,378

Benefits paid from scheme (3,264) (8,098)

Settlements with scheme members – –

Expenses paid (347) (533)

Closing present value of scheme obligations 173,420 155,685

A summary of the scheme’s recent experience is shown below:

2012 2011 2010 2009 2008 2007 2006

£000 £000 £000 £000 £000 £000 £000

Experience gains/(losses) on scheme obligations 4,372 – – – – 2,783 (3,310)

Experience gains/(losses) on scheme assets 9,710 (5,596) 6,075 (3,678) (18,107) 75 6,480

Additional memorandum information at the end of the current and previous six accounting periods is presented below:

2012 2011 2010 2009 2008 2007 2006

£000 £000 £000 £000 £000 £000 £000

Present value of scheme obligations 173,420 155,685 146,737 140,676 101,615 106,793 137,461

Fair value of scheme assets (156,513) (140,517) (144,056) (118,391) (115,166) (127,576) (133,660)

Present value of unfunded obligations/

(surplus scheme assets) 16,907 15,168 2,681 22,285 (13,551) (20,783) 3,801

Gross liability recognised on balance sheet – – – – – – 3,801

Assumptions regarding future mortality experience are set based on professional advice, published statistics and actual experience.

The average life expectancy in years of a pensioner retiring at age 60 on the balance sheet date is as follows:

2012 2011

years years

Male 26.9 26.6

Female 28.3 27.8

The average life expectancy in years of a pensioner retiring at 60, 15 years after the balance sheet date is as follows:

2012 2011

years years

Male 28.3 27.7

Female 29.8 29.0

Other principal actuarial assumptions are as follows:

2012 2011

% %

Discount rate 4.5 4.9

Expected return on scheme assets 5.6 5.8

Inflation assumption (RPI) 2.9 3.1

Inflation assumption (CPI) 2.1 2.3

Pension increases 2.9 3.1

The triennial valuation carried out as at 31 December 2011 resulted in a deficit position of £19.7 million. The Group agreed to fund the

£19.7 million deficit paying instalments over five years. During the year the Group made its first instalment of £1.8 million to the defined

benefit scheme (2011: £1.7 million) which included £0.2 million for the expenses of the pension fund (2011: £0.2 million). 61% of any scheme

surplus or deficit calculated is recharged or refunded to Syndicate 33.

The expected return on scheme assets is based on historical data and management’s expectations of long-term future returns. While

management believes that the actuarial assumptions are appropriate, any significant changes to those could affect the balance sheet and

income statement. Whilst an additional one year of life expectancy for all scheme members might be expected to reduce the present value

of unfunded obligations at 31 December 2012 by approximately £4,650,000 (2011: £1,396,000), the Group considers that the most sensitive

and judgemental assumptions are the discount rate and inflation.

Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012 99