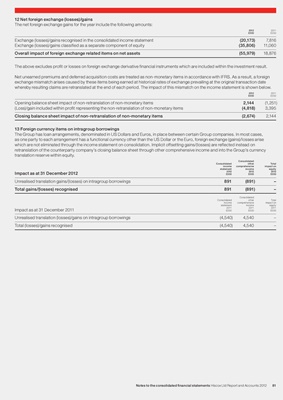

12 Net foreign exchange (losses)/gains

The net foreign exchange gains for the year include the following amounts:

2012 2011

£000 £000

Exchange (losses)/gains recognised in the consolidated income statement (20,173) 7,816

Exchange (losses)/gains classified as a separate component of equity (35,806) 11,060

Overall impact of foreign exchange related items on net assets (55,979) 18,876

The above excludes profit or losses on foreign exchange derivative financial instruments which are included within the investment result.

Net unearned premiums and deferred acquisition costs are treated as non-monetary items in accordance with IFRS. As a result, a foreign

exchange mismatch arises caused by these items being earned at historical rates of exchange prevailing at the original transaction date

whereby resulting claims are retranslated at the end of each period. The impact of this mismatch on the income statement is shown below.

2012 2011

£000 £000

Opening balance sheet impact of non-retranslation of non-monetary items 2,144 (1,251)

(Loss)/gain included within profit representing the non-retranslation of non-monetary items (4,818) 3,395

Closing balance sheet impact of non-retranslation of non-monetary items (2,674) 2,144

13 Foreign currency items on intragroup borrowings

The Group has loan arrangements, denominated in US Dollars and Euros, in place between certain Group companies. In most cases,

as one party to each arrangement has a functional currency other than the US Dollar or the Euro, foreign exchange (gains)/losses arise

which are not eliminated through the income statement on consolidation. Implicit offsetting gains/(losses) are reflected instead on

retranslation of the counterparty company’s closing balance sheet through other comprehensive income and into the Group’s currency

translation reserve within equity.

Consolidated

Consolidated other Total

income comprehensive impact on

statement income equity

2012 2012 2012

Impact as at 31 December 2012 £000 £000 £000

Unrealised translation gains/(losses) on intragroup borrowings 891 (891) –

Total gains/(losses) recognised 891 (891) –

Consolidated

Consolidated other Total

income comprehensive impact on

statement income equity

2011 2011 2011

Impact as at 31 December 2011 £000 £000 £000

Unrealised translation (losses)/gains on intragroup borrowings (4,540) 4,540 –

Total (losses)/gains recognised (4,540) 4,540 –

Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012 81