Notes to the consolidated

financial statements

continued

3 Management of risk continued

3.2 Financial risk continued

(d) Credit risk continued

The Group also mitigates counterparty credit risk by concentrating debt and fixed income investments in highly liquid instruments, including

a particular emphasis on government bonds issued mainly by North American countries and the European Union, excluding those from

Portugal, Greece, Ireland, Italy and Spain.

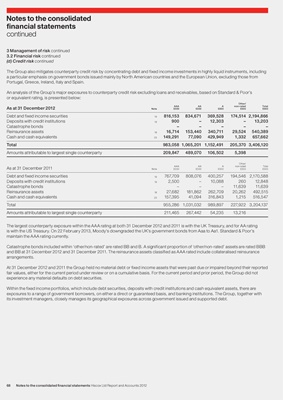

An analysis of the Group’s major exposures to counterparty credit risk excluding loans and receivables, based on Standard & Poor’s

or equivalent rating, is presented below:

Other/

AAA AA A non-rated Total

As at 31 December 2012 Note £000 £000 £000 £000 £000

Debt and fixed income securities 19 816,153 834,671 369,528 174,514 2,194,866

Deposits with credit institutions 19 900 – 12,303 – 13,203

Catastrophe bonds – – – – –

Reinsurance assets 18 16,714 153,440 340,711 29,524 540,389

Cash and cash equivalents 23 149,291 77,090 429,949 1,332 657,662

Total 983,058 1,065,201 1,152,491 205,370 3,406,120

Amounts attributable to largest single counterparty 209,847 489,070 106,502 5,398

Other/

AAA AA A non-rated Total

As at 31 December 2011 Note £000 £000 £000 £000 £000

Debt and fixed income securities 19 767,709 808,076 400,257 194,546 2,170,588

Deposits with credit institutions 19 2,500 – 10,088 260 12,848

Catastrophe bonds – – – 11,639 11,639

Reinsurance assets 18 27,682 181,862 262,709 20,262 492,515

Cash and cash equivalents 23 157,395 41,094 316,843 1,215 516,547

Total 955,286 1,031,032 989,897 227,922 3,204,137

Amounts attributable to largest single counterparty 211,465 267,442 54,235 13,216

The largest counterparty exposure within the AAA rating at both 31 December 2012 and 2011 is with the UK Treasury, and for AA rating

is with the US Treasury. On 22 February 2013, Moody's downgraded the UK’s government bonds from Aaa to Aa1. Standard & Poor’s

maintain the AAA rating currently.

Catastrophe bonds included within ‘other/non-rated’ are rated BB and B. A significant proportion of ‘other/non-rated’ assets are rated BBB

and BB at 31 December 2012 and 31 December 2011. The reinsurance assets classified as AAA rated include collateralised reinsurance

arrangements.

At 31 December 2012 and 2011 the Group held no material debt or fixed income assets that were past due or impaired beyond their reported

fair values, either for the current period under review or on a cumulative basis. For the current period and prior period, the Group did not

experience any material defaults on debt securities.

Within the fixed income portfolios, which include debt securities, deposits with credit institutions and cash equivalent assets, there are

exposures to a range of government borrowers, on either a direct or guaranteed basis, and banking institutions. The Group, together with

its investment managers, closely manages its geographical exposures across government issued and supported debt.

68 Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012