Notes to the consolidated

financial statements

continued

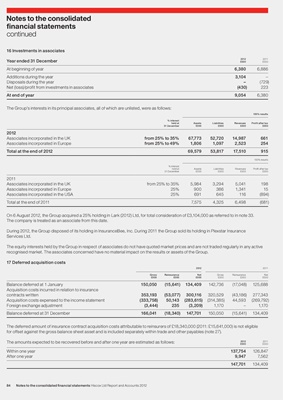

16 Investments in associates

2012 2011

Year ended 31 December £000 £000

At beginning of year 6,380 6,886

Additions during the year 3,104 –

Disposals during the year – (729)

Net (loss)/profit from investments in associates (430) 223

At end of year 9,054 6,380

The Group’s interests in its principal associates, all of which are unlisted, were as follows:

100% results

% interest

held at Assets Liabilities Revenues Profit after tax

31 December £000 £000 £000 £000

2012

Associates incorporated in the UK from 25% to 35% 67,773 52,720 14,987 661

Associates incorporated in Europe from 25% to 49% 1,806 1,097 2,523 254

Total at the end of 2012 69,579 53,817 17,510 915

100% results

% interest

held at Assets Liabilities Revenues Profit after tax

31 December £000 £000 £000 £000

2011

Associates incorporated in the UK from 25% to 35% 5,984 3,294 5,041 198

Associates incorporated in Europe 25% 900 386 1,341 15

Associates incorporated in the USA 25% 691 645 116 (894)

Total at the end of 2011 7,575 4,325 6,498 (681)

On 6 August 2012, the Group acquired a 25% holding in Lark (2012) Ltd, for total consideration of £3,104,000 as referred to in note 33.

The company is treated as an associate from this date.

During 2012, the Group disposed of its holding in InsuranceBee, Inc. During 2011 the Group sold its holding in Plexstar Insurance

Services Ltd.

The equity interests held by the Group in respect of associates do not have quoted market prices and are not traded regularly in any active

recognised market. The associates concerned have no material impact on the results or assets of the Group.

17 Deferred acquisition costs

2012 2011

Gross Reinsurance Net Gross Reinsurance Net

£000 £000 £000 £000 £000 £000

Balance deferred at 1 January 150,050 (15,641) 134,409 142,736 (17,048) 125,688

Acquisition costs incurred in relation to insurance

contracts written 353,193 (53,077) 300,116 320,529 (43,186) 277,343

Acquisition costs expensed to the income statement (333,758) 50,143 (283,615) (314,385) 44,593 (269,792)

Foreign exchange adjustment (3,444) 235 (3,209) 1,170 – 1,170

Balance deferred at 31 December 166,041 (18,340) 147,701 150,050 (15,641) 134,409

The deferred amount of insurance contract acquisition costs attributable to reinsurers of £18,340,000 (2011: £15,641,000) is not eligible

for offset against the gross balance sheet asset and is included separately within trade and other payables (note 27).

The amounts expected to be recovered before and after one year are estimated as follows: 2012

£000

2011

£000

Within one year 137,754 126,847

After one year 9,947 7,562

147,701 134,409

84 Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012