3 Management of risk continued

3.2 Financial risk continued

(e) Liquidity risk continued

The available headroom of working capital is monitored through the use of a detailed Group cash flow forecast which is reviewed

by management monthly or more frequently as required.

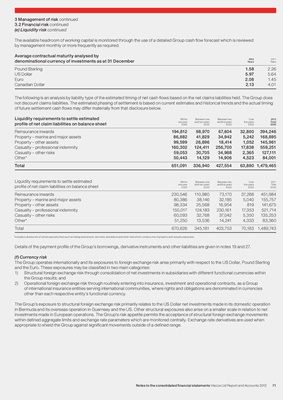

Average contractual maturity analysed by

2012 2011

denominational currency of investments as at 31 December Years Years

Pound Sterling 1.58 2.26

US Dollar 5.97 5.64

Euro 2.08 1.45

Canadian Dollar 2.13 4.01

The following is an analysis by liability type of the estimated timing of net cash flows based on the net claims liabilities held. The Group does

not discount claims liabilities. The estimated phasing of settlement is based on current estimates and historical trends and the actual timing

of future settlement cash flows may differ materially from that disclosure below.

Liquidity requirements to settle estimated Within Between one Between two Over 2012

one year and two years and five years five years Total

profile of net claim liabilities on balance sheet £000 £000 £000 £000 £000

Reinsurance inwards 194,812 98,970 67,604 32,860 394,246

Property – marine and major assets 86,882 41,829 34,942 5,242 168,895

Property – other assets 99,599 26,896 18,414 1,052 145,961

Casualty – professional indemnity 160,302 124,411 256,700 17,838 559,251

Casualty – other risks 59,053 30,705 34,988 2,365 127,111

Other* 50,443 14,129 14,906 4,523 84,001

Total 651,091 336,940 427,554 63,880 1,479,465

Liquidity requirements to settle estimated Within Between one Between two Over 2011

one year and two years and five years five years Total

profile of net claim liabilities on balance sheet £000 £000 £000 £000 £000

Reinsurance inwards 230,546 110,980 73,170 37,288 451,984

Property – marine and major assets 80,386 38,146 32,185 5,040 155,757

Property – other assets 98,334 25,568 16,954 819 141,675

Casualty – professional indemnity 150,017 124,183 230,161 17,353 521,714

Casualty – other risks 60,093 32,768 37,042 5,350 135,253

Other* 51,250 13,536 14,241 4,333 83,360

Total 670,626 345,181 403,753 70,183 1,489,743

*Includes a diverse mix of certain specialty lines such as kidnap and ransom, terrorism, bloodstock and other risks which contain a mix of property and casualty exposures.

Details of the payment profile of the Group’s borrowings, derivative instruments and other liabilities are given in notes 19 and 27.

(f) Currency risk

The Group operates internationally and its exposures to foreign exchange risk arise primarily with respect to the US Dollar, Pound Sterling

and the Euro. These exposures may be classified in two main categories:

1) Structural foreign exchange risk through consolidation of net investments in subsidiaries with different functional currencies within

the Group results; and

2) Operational foreign exchange risk through routinely entering into insurance, investment and operational contracts, as a Group

of international insurance entities serving international communities, where rights and obligations are denominated in currencies

other than each respective entity’s functional currency.

The Group’s exposure to structural foreign exchange risk primarily relates to the US Dollar net investments made in its domestic operation

in Bermuda and its overseas operation in Guernsey and the US. Other structural exposures also arise on a smaller scale in relation to net

investments made in European operations. The Group’s risk appetite permits the acceptance of structural foreign exchange movements

within defined aggregate limits and exchange rate parameters which are monitored centrally. Exchange rate derivatives are used when

appropriate to shield the Group against significant movements outside of a defined range.

Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012 71