Corporate Group key performance indicators

2012 2011

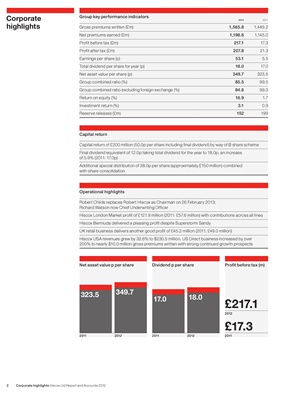

highlights Gross premiums written (£m) 1,565.8 1,449.2

Net premiums earned (£m) 1,198.6 1,145.0

Profit before tax (£m) 217.1 17.3

Profit after tax (£m) 207.8 21.3

Earnings per share (p) 53.1 5.5

Total dividend per share for year (p) 18.0 17.0

Net asset value per share (p) 349.7 323.5

Group combined ratio (%) 85.5 99.5

Group combined ratio excluding foreign exchange (%) 84.6 99.3

Return on equity (%) 16.9 1.7

Investment return (%) 3.1 0.9

Reserve releases (£m) 152 199

Capital return

Capital return of £200 million (50.0p per share including final dividend) by way of B share scheme

Final dividend equivalent of 12.0p taking total dividend for the year to 18.0p, an increase

of 5.9% (2011: 17.0p)

Additional special distribution of 38.0p per share (approximately £150 million) combined

with share consolidation

Operational highlights

Robert Childs replaces Robert Hiscox as Chairman on 26 February 2013;

Richard Watson now Chief Underwriting Officer

Hiscox London Market profit of £121.9 million (2011: £57.6 million) with contributions across all lines

Hiscox Bermuda delivered a pleasing profit despite Superstorm Sandy

UK retail business delivers another good profit of £45.2 million (2011: £49.0 million)

Hiscox USA revenues grew by 32.6% to $230.5 million. US Direct business increased by over

200% to nearly $10.0 million gross premiums written with strong continued growth prospects

Net asset value p per share Dividend p per share Profit before tax (m)

323.5 349.7

17.0 18.0

£217.1

2012

£17.3

2011 2012 2011 2012 2011

2 Corporate highlights Hiscox Ltd Report and Accounts 2012