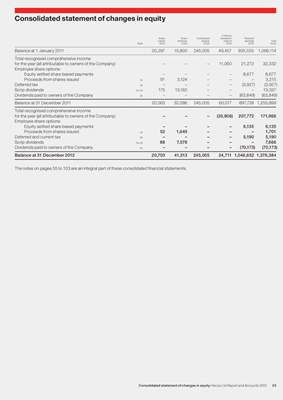

Consolidated statement of changes in equity

Currency

Share Share Contributed translation Retained

capital premium surplus reserve earnings Total

Note £000 £000 £000 £000 £000 £000

Balance at 1 January 2011 20,297 15,800 245,005 49,457 935,555 1,266,114

Total recognised comprehensive income

for the year (all attributable to owners of the Company) – – – 11,060 21,272 32,332

Employee share options:

Equity settled share based payments – – – – 8,677 8,677

Proceeds from shares issued 24 91 3,124 – – – 3,215

Deferred tax 29 – – – – (3,927) (3,927)

Scrip dividends 24, 32 175 13,162 – – – 13,337

Dividends paid to owners of the Company 32 – – – – (63,849) (63,849)

Balance at 31 December 2011 20,563 32,086 245,005 60,517 897,728 1,255,899

Total recognised comprehensive income

for the year (all attributable to owners of the Company) – – – (35,806) 207,772 171,966

Employee share options:

Equity settled share based payments – – – – 6,135 6,135

Proceeds from shares issued 24 52 1,649 – – – 1,701

Deferred and current tax 29 – – – – 5,190 5,190

Scrip dividends 24, 32 88 7,578 – – – 7,666

Dividends paid to owners of the Company 32 – – – – (70,173) (70,173)

Balance at 31 December 2012 20,703 41,313 245,005 24,711 1,046,652 1,378,384

The notes on pages 55 to 103 are an integral part of these consolidated financial statements.

Consolidated statement of changes in equity Hiscox Ltd Report and Accounts 2012 53