Notes to the consolidated

financial statements

continued

3 Management of risk continued

3.2 Financial risk continued

(f) Currency risk continued

At a consolidated level, the Group is exposed to foreign exchange gains or losses on balances held between Group companies where one

party to the transaction has a functional currency other than Pound Sterling. To the extent that such gains or losses are considered to relate

to economic hedges and intragroup borrowings, they are disclosed separately in order for users of the financial statements to obtain a fuller

understanding of the Group’s financial performance (note 13).

The Group has the ability to draw on its current borrowing facility in any currency requested, enabling the Group to match its funding

requirements with the relevant currency.

Operational foreign exchange risk is controlled within the Group’s individual entities. The assets of the Group’s overseas operations are

generally invested in the same currencies as their underlying insurance and investment liabilities, producing a natural hedge. Due attention

is paid to local regulatory solvency and risk-based capital requirements.

Details of all foreign currency derivative contracts entered into with external parties are given in note 21. All foreign currency derivative

transactions with external parties are managed centrally. Included in the tables below are net non-monetary liabilities of £181 million

(2011: £169 million) which are denominated in foreign currencies.

As a result of the accounting treatment for non-monetary items, the Group may also experience volatility in its income statement during

a period when movements in foreign exchange rates fluctuate significantly. In accordance with IFRS, non-monetary items are recorded at

original transaction rates and are not remeasured at the reporting date. These items include unearned premiums, deferred acquisition costs

and reinsurers’ share of unearned premiums. Consequently, a mismatch arises in the income statement between the amount of premium

recognised at historical transaction rates, and the related claims which are retranslated using currency rates in force at the reporting date.

The Group considers this to be a timing issue which can cause significant volatility in the income statements. Further details of the impact

of the accounting treatment are provided in note 12.

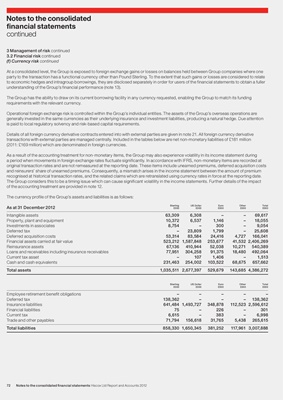

The currency profile of the Group’s assets and liabilities is as follows:

Sterling US Dollar Euro Other Total

As at 31 December 2012 £000 £000 £000 £000 £000

Intangible assets 63,309 6,308 – – 69,617

Property, plant and equipment 10,372 6,537 1,146 – 18,055

Investments in associates 8,754 – 300 – 9,054

Deferred tax – 23,809 1,799 – 25,608

Deferred acquisition costs 53,314 83,584 24,416 4,727 166,041

Financial assets carried at fair value 523,212 1,587,848 253,677 41,532 2,406,269

Reinsurance assets 67,136 410,944 52,038 10,271 540,389

Loans and receivables including insurance receivables 77,951 304,258 91,375 18,480 492,064

Current tax asset – 107 1,406 – 1,513

Cash and cash equivalents 231,463 254,002 103,522 68,675 657,662

Total assets 1,035,511 2,677,397 529,679 143,685 4,386,272

Sterling US Dollar Euro Other Total

£000 £000 £000 £000 £000

Employee retirement benefit obligations – – – – –

Deferred tax 138,362 – – – 138,362

Insurance liabilities 641,484 1,493,727 348,878 112,523 2,596,612

Financial liabilities 75 – 226 – 301

Current tax 6,615 – 383 – 6,998

Trade and other payables 71,794 156,618 31,765 5,438 265,615

Total liabilities 858,330 1,650,345 381,252 117,961 3,007,888

72 Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012