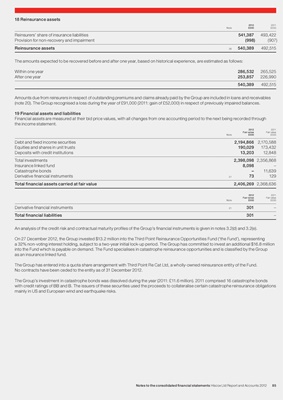

18 Reinsurance assets

2012 2011

Note £000 £000

Reinsurers’ share of insurance liabilities 541,387 493,422

Provision for non-recovery and impairment (998) (907)

Reinsurance assets 26 540,389 492,515

The amounts expected to be recovered before and after one year, based on historical experience, are estimated as follows:

Within one year 286,532 265,525

After one year 253,857 226,990

540,389 492,515

Amounts due from reinsurers in respect of outstanding premiums and claims already paid by the Group are included in loans and receivables

(note 20). The Group recognised a loss during the year of £91,000 (2011: gain of £52,000) in respect of previously impaired balances.

19 Financial assets and liabilities

Financial assets are measured at their bid price values, with all changes from one accounting period to the next being recorded through

the income statement.

2012 2011

Fair value Fair value

Note £000 £000

Debt and fixed income securities 2,194,866 2,170,588

Equities and shares in unit trusts 190,029 173,432

Deposits with credit institutions 13,203 12,848

Total investments 2,398,098 2,356,868

Insurance linked fund 8,098 –

Catastrophe bonds – 11,639

Derivative financial instruments 21 73 129

Total financial assets carried at fair value 2,406,269 2,368,636

2012 2011

Fair value Fair value

Note £000 £000

Derivative financial instruments 21 301 –

Total financial liabilities 301 –

An analysis of the credit risk and contractual maturity profiles of the Group’s financial instruments is given in notes 3.2(d) and 3.2(e).

On 27 December 2012, the Group invested $13.2 million into the Third Point Reinsurance Opportunities Fund (‘the Fund’), representing

a 32% non-voting interest holding, subject to a two-year initial lock-up period. The Group has committed to invest an additional $16.8 million

into the Fund which is payable on demand. The Fund specialises in catastrophe reinsurance opportunities and is classified by the Group

as an insurance linked fund.

The Group has entered into a quota share arrangement with Third Point Re Cat Ltd, a wholly-owned reinsurance entity of the Fund.

No contracts have been ceded to the entity as of 31 December 2012.

The Group’s investment in catastrophe bonds was dissolved during the year (2011: £11.6 million). 2011 comprised 16 catastrophe bonds

with credit ratings of BB and B. The issuers of these securities used the proceeds to collateralise certain catastrophe reinsurance obligations

mainly in US and European wind and earthquake risks.

Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012 85