Notes to the consolidated

financial statements

continued

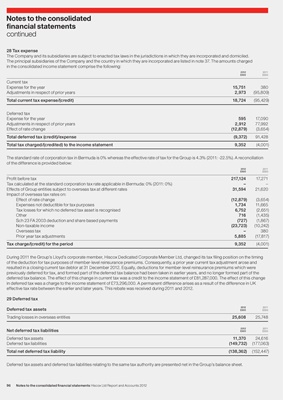

28 Tax expense

The Company and its subsidiaries are subject to enacted tax laws in the jurisdictions in which they are incorporated and domiciled.

The principal subsidiaries of the Company and the country in which they are incorporated are listed in note 37. The amounts charged

in the consolidated income statement comprise the following:

2012 2011

£000 £000

Current tax

Expense for the year 15,751 380

Adjustments in respect of prior years 2,973 (95,809)

Total current tax expense/(credit) 18,724 (95,429)

Deferred tax

Expense for the year 595 17,090

Adjustments in respect of prior years 2,912 77,992

Effect of rate change (12,879) (3,654)

Total deferred tax (credit)/expense (9,372) 91,428

Total tax charged/(credited) to the income statement 9,352 (4,001)

The standard rate of corporation tax in Bermuda is 0% whereas the effective rate of tax for the Group is 4.3% (2011: -22.5%). A reconciliation

of the difference is provided below:

2012 2011

£000 £000

Profit before tax 217,124 17,271

Tax calculated at the standard corporation tax rate applicable in Bermuda: 0% (2011: 0%) – –

Effects of Group entities subject to overseas tax at different rates 31,594 21,620

Impact of overseas tax rates on:

Effect of rate change (12,879) (3,654)

Expenses not deductible for tax purposes 1,734 11,665

Tax losses for which no deferred tax asset is recognised 6,752 (2,651)

Other 716 (1,435)

Sch 23 FA 2003 deduction and share based payments (727) (1,867)

Non-taxable income (23,723) (10,242)

Overseas tax – 380

Prior year tax adjustments 5,885 (17,817)

Tax charge/(credit) for the period 9,352 (4,001)

During 2011 the Group’s Lloyd’s corporate member, Hiscox Dedicated Corporate Member Ltd, changed its tax filing position on the timing

of the deduction for tax purposes of member-level reinsurance premiums. Consequently, a prior year current tax adjustment arose and

resulted in a closing current tax debtor at 31 December 2012. Equally, deductions for member-level reinsurance premiums which were

previously deferred for tax, and formed part of the deferred tax balance had been taken in earlier years, and no longer formed part of the

deferred tax balance. The effect of this change in current tax was a credit to the income statement of £81,287,000. The effect of this change

in deferred tax was a charge to the income statement of £73,296,000. A permanent difference arises as a result of the difference in UK

effective tax rate between the earlier and later years. This rebate was received during 2011 and 2012.

29 Deferred tax

2012 2011

Deferred tax assets £000 £000

Trading losses in overseas entities 25,608 25,748

2012 2011

Net deferred tax liabilities £000 £000

Deferred tax assets 11,370 24,616

Deferred tax liabilities (149,732) (177,063)

Total net deferred tax liability (138,362) (152,447)

Deferred tax assets and deferred tax liabilities relating to the same tax authority are presented net in the Group’s balance sheet.

96 Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012