3 Management of risk continued

3.2 Financial risk continued

(f) Currency risk continued

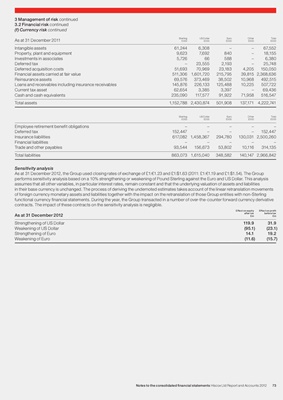

Sterling US Dollar Euro Other Total

As at 31 December 2011 £000 £000 £000 £000 £000

Intangible assets 61,244 6,308 – – 67,552

Property, plant and equipment 9,623 7,692 840 – 18,155

Investments in associates 5,726 66 588 – 6,380

Deferred tax – 23,555 2,193 – 25,748

Deferred acquisition costs 51,693 70,969 23,183 4,205 150,050

Financial assets carried at fair value 511,306 1,601,720 215,795 39,815 2,368,636

Reinsurance assets 69,576 373,469 38,502 10,968 492,515

Loans and receivables including insurance receivables 145,876 226,133 125,488 10,225 507,722

Current tax asset 62,654 3,385 3,397 – 69,436

Cash and cash equivalents 235,090 117,577 91,922 71,958 516,547

Total assets 1,152,788 2,430,874 501,908 137,171 4,222,741

Sterling US Dollar Euro Other Total

£000 £000 £000 £000 £000

Employee retirement benefit obligations – – – – –

Deferred tax 152,447 – – – 152,447

Insurance liabilities 617,082 1,458,367 294,780 130,031 2,500,260

Financial liabilities – – – – –

Trade and other payables 93,544 156,673 53,802 10,116 314,135

Total liabilities 863,073 1,615,040 348,582 140,147 2,966,842

Sensitivity analysis

As at 31 December 2012, the Group used closing rates of exchange of £1:€1.23 and £1:$1.63 (2011: £1:€1.19 and £1:$1.54). The Group

performs sensitivity analysis based on a 10% strengthening or weakening of Pound Sterling against the Euro and US Dollar. This analysis

assumes that all other variables, in particular interest rates, remain constant and that the underlying valuation of assets and liabilities

in their base currency is unchanged. The process of deriving the undernoted estimates takes account of the linear retranslation movements

of foreign currency monetary assets and liabilities together with the impact on the retranslation of those Group entities with non-Sterling

functional currency financial statements. During the year, the Group transacted in a number of over-the-counter forward currency derivative

contracts. The impact of these contracts on the sensitivity analysis is negligible.

Effect on equity Effect on profit

after tax before tax

As at 31 December 2012 £m £m

Strengthening of US Dollar 119.9 31.9

Weakening of US Dollar (95.1) (23.1)

Strengthening of Euro 14.1 19.2

Weakening of Euro (11.6) (15.7)

Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012 73