Notes to the consolidated

financial statements

continued

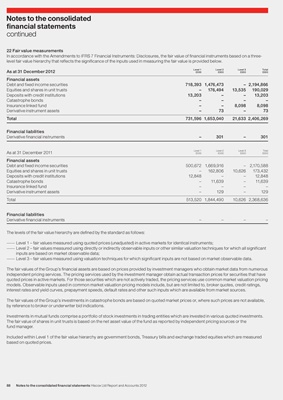

22 Fair value measurements

In accordance with the Amendments to IFRS 7 Financial Instruments: Disclosures, the fair value of financial instruments based on a three-

level fair value hierarchy that reflects the significance of the inputs used in measuring the fair value is provided below.

Level 1 Level 2 Level 3 Total

As at 31 December 2012 £000 £000 £000 £000

Financial assets

Debt and fixed income securities 718,393 1,476,473 – 2,194,866

Equities and shares in unit trusts – 176,494 13,535 190,029

Deposits with credit institutions 13,203 – – 13,203

Catastrophe bonds – – – –

Insurance linked fund – – 8,098 8,098

Derivative instrument assets – 73 – 73

Total 731,596 1,653,040 21,633 2,406,269

Financial liabilities

Derivative financial instruments – 301 – 301

Level 1 Level 2 Level 3 Total

As at 31 December 2011 £000 £000 £000 £000

Financial assets

Debt and fixed income securities 500,672 1,669,916 – 2,170,588

Equities and shares in unit trusts – 162,806 10,626 173,432

Deposits with credit institutions 12,848 – – 12,848

Catastrophe bonds – 11,639 – 11,639

Insurance linked fund – – – –

Derivative instrument assets – 129 – 129

Total 513,520 1,844,490 10,626 2,368,636

Financial liabilities

Derivative financial instruments – – – –

The levels of the fair value hierarchy are defined by the standard as follows:

Level 1 – fair values measured using quoted prices (unadjusted) in active markets for identical instruments;

Level 2 – fair values measured using directly or indirectly observable inputs or other similar valuation techniques for which all significant

inputs are based on market observable data;

Level 3 – fair values measured using valuation techniques for which significant inputs are not based on market observable data.

The fair values of the Group’s financial assets are based on prices provided by investment managers who obtain market data from numerous

independent pricing services. The pricing services used by the investment manager obtain actual transaction prices for securities that have

quoted prices in active markets. For those securities which are not actively traded, the pricing services use common market valuation pricing

models. Observable inputs used in common market valuation pricing models include, but are not limited to, broker quotes, credit ratings,

interest rates and yield curves, prepayment speeds, default rates and other such inputs which are available from market sources.

The fair values of the Group’s investments in catastrophe bonds are based on quoted market prices or, where such prices are not available,

by reference to broker or underwriter bid indications.

Investments in mutual funds comprise a portfolio of stock investments in trading entities which are invested in various quoted investments.

The fair value of shares in unit trusts is based on the net asset value of the fund as reported by independent pricing sources or the

fund manager.

Included within Level 1 of the fair value hierarchy are government bonds, Treasury bills and exchange traded equities which are measured

based on quoted prices.

88 Notes to the consolidated financial statements Hiscox Ltd Report and Accounts 2012