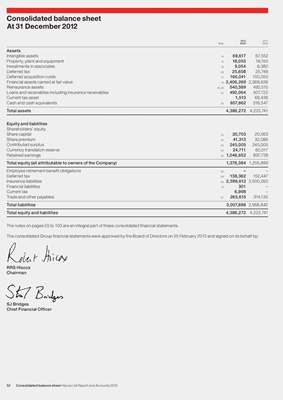

Consolidated balance sheet

At 31 December 2012

2012 2011

Note £000 £000

Assets

Intangible assets 14 69,617 67,552

Property, plant and equipment 15 18,055 18,155

Investments in associates 16 9,054 6,380

Deferred tax 29 25,608 25,748

Deferred acquisition costs 17 166,041 150,050

Financial assets carried at fair value 19 2,406,269 2,368,636

Reinsurance assets 18, 26 540,389 492,515

Loans and receivables including insurance receivables 20 492,064 507,722

Current tax asset 1,513 69,436

Cash and cash equivalents 23 657,662 516,547

Total assets 4,386,272 4,222,741

Equity and liabilities

Shareholders’ equity

Share capital 24 20,703 20,563

Share premium 24 41,313 32,086

Contributed surplus 24 245,005 245,005

Currency translation reserve 25 24,711 60,517

Retained earnings 25 1,046,652 897,728

Total equity (all attributable to owners of the Company) 1,378,384 1,255,899

Employee retirement benefit obligations 30 – –

Deferred tax 29 138,362 152,447

Insurance liabilities 26 2,596,612 2,500,260

Financial liabilities 19 301 –

Current tax 6,998 –

Trade and other payables 27 265,615 314,135

Total liabilities 3,007,888 2,966,842

Total equity and liabilities 4,386,272 4,222,741

The notes on pages 55 to 103 are an integral part of these consolidated financial statements.

The consolidated Group financial statements were approved by the Board of Directors on 25 February 2013 and signed on its behalf by:

RRS Hiscox

Chairman

SJ Bridges

Chief Financial Officer

52 Consolidated balance sheet Hiscox Ltd Report and Accounts 2012