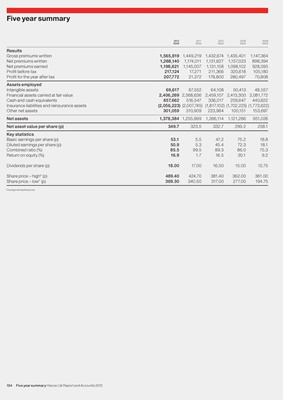

Five year summary

2012 2011 2010 2009 2008

£000 £000 £000 £000 £000

Results

Gross premiums written 1,565,819 1,449,219 1,432,674 1,435,401 1,147,364

Net premiums written 1,268,140 1,174,011 1,131,627 1,157,023 898,394

Net premiums earned 1,198,621 1,145,007 1,131,158 1,098,102 928,095

Profit before tax 217,124 17,271 211,366 320,618 105,180

Profit for the year after tax 207,772 21,272 178,800 280,497 70,808

Assets employed

Intangible assets 69,617 67,552 64,108 50,413 48,557

Financial assets carried at fair value 2,406,269 2,368,636 2,459,107 2,413,300 2,081,772

Cash and cash equivalents 657,662 516,547 336,017 259,647 440,622

Insurance liabilities and reinsurance assets (2,056,223) (2,007,745) (1,817,102) (1,702,225) (1,773,622)

Other net assets 301,059 310,909 223,984 100,151 153,697

Net assets 1,378,384 1,255,899 1,266,114 1,121,286 951,026

Net asset value per share (p) 349.7 323.5 332.7 299.2 258.1

Key statistics

Basic earnings per share (p) 53.1 5.5 47.2 75.2 18.8

Diluted earnings per share (p) 50.9 5.3 45.4 72.3 18.1

Combined ratio (%) 85.5 99.5 89.3 86.0 75.3

Return on equity (%) 16.9 1.7 16.5 30.1 9.2

Dividends per share (p) 18.00 17.00 16.50 15.00 12.75

Share price – high* (p) 489.40 424.70 381.40 362.00 361.00

Share price – low* (p) 369.30 340.50 317.00 277.00 194.75

*Closing mid-market prices.

104 Five year summary Hiscox Ltd Report and Accounts 2012