100 LV= Annual Report 2012

Notes to the financial statements continued

31 December 2012

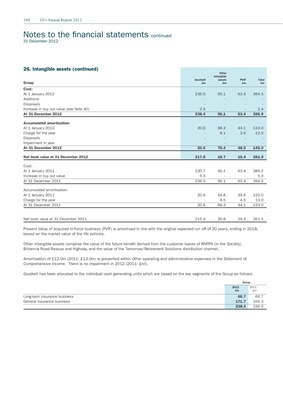

26. Intangible assets (continued)

Other

intangible

Goodwill assets PVIF Total

Group £m £m £m £m

Cost:

At 1 January 2012 236.0 95.1 63.4 394.5

Additions - - - -

Disposals - - - -

Increase in buy out value (see Note 40) 2.4 - - 2.4

At 31 December 2012 238.4 95.1 63.4 396.9

Accumulated amortisation:

At 1 January 2012 20.6 68.3 44.1 133.0

Charge for the year - 8.1 3.9 12.0

Disposals - - - -

Impairment in year - - - -

At 31 December 2012 20.6 76.4 48.0 145.0

Net book value at 31 December 2012 217.8 18.7 15.4 251.9

Cost:

At 1 January 2011 230.7 95.1 63.4 389.2

Increase in buy out value 5.3 - - 5.3

At 31 December 2011 236.0 95.1 63.4 394.5

Accumulated amortisation:

At 1 January 2011 20.6 59.8 39.6 120.0

Charge for the year - 8.5 4.5 13.0

At 31 December 2011 20.6 68.3 44.1 133.0

Net book value at 31 December 2011 215.4 26.8 19.3 261.5

Present Value of acquired In-Force business (PVIF) is amortised in line with the original expected run off of 20 years, ending in 2018,

based on the market value of the life policies.

Other intangible assets comprise the value of the future benefit derived from the customer bases of RNPFN (in the Society),

Britannia Road Rescue and Highway, and the value of the Tomorrow/Retirement Solutions distribution channel.

Amortisation of £12.0m (2011: £13.0m) is presented within Other operating and administrative expenses in the Statement of

Comprehensive Income. There is no impairment in 2012 (2011: £nil).

Goodwill has been allocated to the individual cash generating units which are based on the key segments of the Group as follows:

Group

2012 2011

£m £m

Long-term insurance business 66.7 66.7

General insurance business 171.7 169.3

238.4 236.0