90 LV= Annual Report 2012

Notes to the Financial Statements continued

31 December 2012

21. Insurance contract liabilities (continued)

Valuation of general insurance contract liabilities

For general insurance contracts, estimates are made for the expected ultimate cost of claims reported as at the Statement of Financial

Position date and the cost of claims incurred but not yet reported (IBNR) to the Group. It can take a significant period of time before the

ultimate cost of claims can be established with certainty, and the final outcome may be better or worse than that provided. Standard

actuarial claims projection techniques are used to estimate outstanding claims. Such methods extrapolate the development of paid and

incurred claims, recoveries from third parties, average cost per claim and ultimate claim numbers for each accident year, based upon

the observed development of earlier years and expected loss ratios. The main assumption underlying these techniques is that past

claims development experience is used to project ultimate claims costs. Allowance for one-off occurrences or changes in legislation,

policy conditions or portfolio mix are also made in arriving at the estimated ultimate cost of claims in order that it represents the most

likely outcome, taking account of all the uncertainties involved. To the extent that the ultimate cost is different from the estimate, where

experience is better or worse than that assumed, the surplus or deficit will be credited or charged to gross benefits and claims within the

Statement of Comprehensive Income in future years.

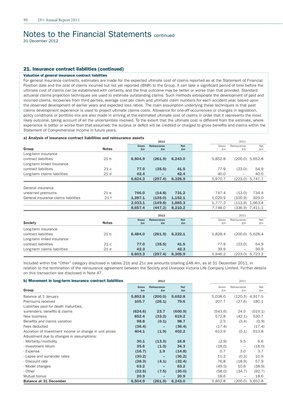

a) Analysis of insurance contract liabilities and reinsurance assets

2012 2011

Gross Reinsurance Net Gross Reinsurance Net

Group Notes £m £m £m £m £m £m

Long-term insurance

contract liabilities 21 b 6,504.9 (261.9) 6,243.0 5,852.8 (200.0) 5,652.8

Long-term linked insurance

contract liabilities 21 c 77.0 (35.5) 41.5 77.9 (23.0) 54.9

Long-term claims liabilities 21 d 42.4 – 42.4 40.0 – 40.0

6,624.3 (297.4) 6,326.9 5,970.7 (223.0) 5,747.7

General insurance

unearned premiums 21 e 746.0 (14.8) 731.2 747.4 (13.0) 734.4

General insurance claims liabilities 21 f 1,287.1 (135.0) 1,152.1 1,029.9 (100.9) 929.0

2,033.1 (149.8) 1,883.3 1,777.3 (113.9) 1,663.4

8,657.4 (447.2) 8,210.2 7,748.0 (336.9) 7,411.1

2012 2011

Gross Reinsurance Net Gross Reinsurance Net

Society Notes £m £m £m £m £m £m

Long-term insurance

contract liabilities 21 b 6,484.0 (261.9) 6,222.1 5,828.4 (200.0) 5,628.4

Long-term linked insurance

contract liabilities 21 c 77.0 (35.5) 41.5 77.9 (23.0) 54.9

Long-term claims liabilities 21 d 42.3 – 42.3 39.9 – 39.9

6,603.3 (297.4) 6,305.9 5,946.2 (223.0) 5,723.2

Included within the “Other” category disclosed in tables 21b and 21c are amounts totalling £48.4m, as at 31 December 2011, in

relation to the termination of the reinsurance agreement between the Society and Liverpool Victoria Life Company Limited. Further details

on this transaction are disclosed in Note 47.

b) Movement in long-term insurance contract liabilities 2012 2011

Gross Reinsurance Net Gross Reinsurance Net

Group £m £m £m £m £m £m

Balance at 1 January 5,852.8 (200.0) 5,652.8 5,038.0 (120.5) 4,917.5

Premiums received 105.7 (26.1) 79.6 207.7 (27.6) 180.1

Liabilities paid for death maturities,

surrenders, benefits & claims (624.6) 23.7 (600.9) (543.6) 24.5 (519.1)

New business 652.4 (33.2) 619.2 572.8 (42.1) 530.7

Benefits and claims variation 98.8 (0.1) 98.7 2.5 (3.4) (0.9)

Fees deducted (36.4) – (36.4) (17.4) – (17.4)

Accretion of investment income or change in unit prices 404.1 (1.9) 402.2 613.9 (0.1) 613.8

Adjustment due to changes in assumptions:

- Mortality/morbidity 30.1 (13.3) 16.8 (2.9) 9.5 6.6

- Investment return 35.6 (1.3) 34.3 (18.0) – (18.0)

- Expense (16.7) 1.9 (14.8) 0.7 3.0 3.7

- Lapse and surrender rates (30.2) – (30.2) 11.2 (0.3) 10.9

- Discount rate (28.3) (4.1) (32.4) 76.8 (18.9) 57.9

- Model changes 63.2 – 63.2 (49.5) 10.6 (38.9)

- Other (22.5) (7.5) (30.0) (58.0) (34.7) (92.7)

Mutual bonus 20.9 – 20.9 18.6 – 18.6

Balance at 31 December 6,504.9 (261.9) 6,243.0 5,852.8 (200.0) 5,652.8