Our Accounts 67

Notes to the Financial Statements continued

31 December 2012

3. Risk management and control (continued)

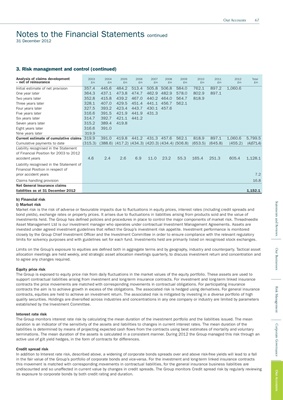

Analysis of claims development 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Total

– net of reinsurance £m £m £m £m £m £m £m £m £m £m £m

Initial estimate of net provision 357.4 445.6 484.2 513.4 505.8 506.8 584.0 762.1 897.2 1,060.6

One year later 364.3 437.1 473.8 474.7 462.9 482.9 578.0 802.9 897.1

Two years later 352.8 415.8 439.2 467.0 440.2 464.0 564.7 818.9

Three years later 328.1 407.0 429.5 451.4 441.1 456.7 562.1

Four years later 327.5 393.2 423.4 443.7 430.1 457.6

Five years later 316.6 391.5 421.9 441.9 431.3

Six years later 314.7 392.7 421.1 441.2

Seven years later 315.2 389.4 419.8

Eight years later 316.6 391.0

Nine years later 319.9

Current estimate of cumulative claims 319.9 391.0 419.8 441.2 431.3 457.6 562.1 818.9 897.1 1,060.6 5,799.5

Cumulative payments to date (315.3) (388.6) (417.2) (434.3) (420.3) (434.4) (506.8) (653.5) (645.8) (455.2) (4,671.4)

Liability recognised in the Statement

of Financial Position for 2003 to 2012

accident years 4.6 2.4 2.6 6.9 11.0 23.2 55.3 165.4 251.3 605.4 1,128.1

Liability recognised in the Statement of

Financial Position in respect of

prior accident years 7.2

Claims handling provision 16.8

Net General Insurance claims

liabilities as at 31 December 2012 1,152.1

b) Financial risk

Statements and Reviews

i) Market risk

Market risk is the risk of adverse or favourable impacts due to fluctuations in equity prices, interest rates (including credit spreads and

bond yields), exchange rates or property prices. It arises due to fluctuations in liabilities arising from products sold and the value of

investments held. The Group has defined policies and procedures in place to control the major components of market risk. Threadneedle

Asset Management Ltd is our investment manager who operates under contractual Investment Management Agreements. Assets are

invested under agreed investment guidelines that reflect the Group’s investment risk appetite. Investment performance is monitored

closely by the Group Chief Investment Officer and the Investment Committee in order to ensure compliance with the relevant regulatory

limits for solvency purposes and with guidelines set for each fund. Investments held are primarily listed on recognised stock exchanges.

Limits on the Group’s exposure to equities are defined both in aggregate terms and by geography, industry and counterparty. Tactical asset

Our Businesses

allocation meetings are held weekly, and strategic asset allocation meetings quarterly, to discuss investment return and concentration and

to agree any changes required.

Equity price risk

The Group is exposed to equity price risk from daily fluctuations in the market values of the equity portfolio. These assets are used to

support contractual liabilities arising from investment and long-term insurance contracts. For investment and long-term linked insurance

contracts the price movements are matched with corresponding movements in contractual obligations. For participating insurance

Risk Management

contracts the aim is to achieve growth in excess of the obligations. The associated risk is hedged using derivatives. For general insurance

contracts, equities are held to achieve an investment return. The associated risk is mitigated by investing in a diverse portfolio of high

quality securities. Holdings are diversified across industries and concentrations in any one company or industry are limited by parameters

established by the Investment Committee.

Interest rate risk

The Group monitors interest rate risk by calculating the mean duration of the investment portfolio and the liabilities issued. The mean

duration is an indicator of the sensitivity of the assets and liabilities to changes in current interest rates. The mean duration of the

Corporate Governance

liabilities is determined by means of projecting expected cash flows from the contracts using best estimates of mortality and voluntary

terminations. The mean duration of the assets is calculated in a consistent manner. During 2012 the Group managed this risk through an

active use of gilt yield hedges, in the form of contracts for differences.

Credit spread risk

In addition to Interest rate risk, described above, a widening of corporate bonds spreads over and above risk-free yields will lead to a fall

in the fair value of the Group’s portfolio of corporate bonds and vice-versa. For the investment and long-term linked insurance contracts

this movement is matched with corresponding movements in contractual liabilities, for the general insurance business liabilities are

undiscounted and so unaffected in current value by changes in credit spreads. The Group monitors Credit spread risk by regularly reviewing

Our Accounts

its exposure to corporate bonds by both credit rating and duration.