108 LV= Annual Report 2012

Notes to the financial statements continued

31 December 2012

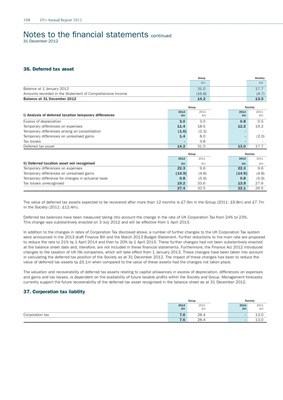

36. Deferred tax asset

Group Society

£m £m

Balance at 1 January 2012 31.0 17.7

Amounts recorded in the Statement of Comprehensive Income (16.8) (4.7)

Balance at 31 December 2012 14.2 13.0

Group Society

2012 2011 2012 2011

i) Analysis of deferred taxation temporary differences £m £m £m £m

Excess of depreciation 3.0 3.0 0.8 0.5

Temporary differences on expenses 11.4 18.5 12.2 19.2

Temporary differences arising on consolidation (1.6) (2.3) - -

Temporary differences on unrealised gains 1.4 8.0 - (2.0)

Tax losses - 3.8 - -

Deferred tax asset 14.2 31.0 13.0 17.7

Group Society

2012 2011 2012 2011

ii) Deferred taxation asset not recognised £m £m £m £m

Temporary differences on expenses 22.3 9.6 22.3 9.6

Temporary differences on unrealised gains (14.9) (4.8) (14.9) (4.8)

Temporary difference for changes in actuarial base 0.8 (5.9) 0.8 (5.9)

Tax losses unrecognised 19.2 33.6 13.9 27.6

27.4 32.5 22.1 26.5

The value of deferred tax assets expected to be recovered after more than 12 months is £7.6m in the Group (2011: £9.8m) and £7.7m

in the Society (2011: £12.4m).

Deferred tax balances have been measured taking into account the change in the rate of UK Corporation Tax from 24% to 23%.

This change was substantively enacted on 3 July 2012 and will be effective from 1 April 2013.

In addition to the changes in rates of Corporation Tax disclosed above, a number of further changes to the UK Corporation Tax system

were announced in the 2013 draft Finance Bill and the March 2013 Budget Statement. Further reductions to the main rate are proposed

to reduce the rate to 21% by 1 April 2014 and then to 20% by 1 April 2015. These further changes had not been substantively enacted

at the balance sheet date and, therefore, are not included in these financial statements. Furthermore, the Finance Act 2012 introduced

changes to the taxation of UK life companies, which will take effect from 1 January 2013. These changes have been taken into account

in calculating the deferred tax position of the Society as at 31 December 2012. The impact of these changes has been to reduce the

value of deferred tax assets by £5.1m when compared to the value of these assets had the changes not taken place.

The valuation and recoverability of deferred tax assets relating to capital allowances in excess of depreciation, differences on expenses

and gains and tax losses, is dependent on the availability of future taxable profits within the Society and Group. Management forecasts

currently support the future recoverability of the deferred tax asset recognised in the balance sheet as at 31 December 2012.

37. Corporation tax liability

Group Society

2012 2011 2012 2011

£m £m £m £m

Corporation tax 7.6 28.4 - 13.0

7.6 28.4 - 13.0