72 LV= Annual Report 2012

Notes to the Financial Statements continued

31 December 2012

3. Risk management and control (continued)

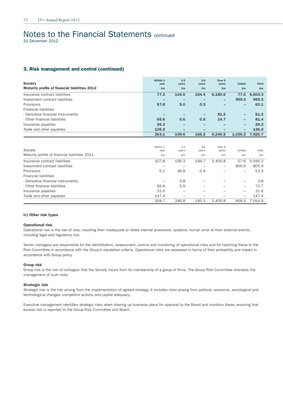

Within 1 1-3 3-5 Over 5

Society year years years years Linked Total

Maturity profile of financial liabilities 2012 £m £m £m £m £m £m

Insurance contract liabilities 77.3 104.0 164.4 6,180.6 77.0 6,603.3

Investment contract liabilities – – – – 959.3 959.3

Provisions 57.8 5.0 0.3 – – 63.1

Financial liabilities

- Derivative financial instruments – – – 51.2 – 51.2

- Other financial liabilities 65.6 0.6 0.5 14.7 – 81.4

Insurance payables 26.2 – – – – 26.2

Trade and other payables 136.2 – – – – 136.2

363.1 109.6 165.2 6,246.5 1,036.3 7,920.7

Within 1 1-3 3-5 Over 5

Society year years years years Linked Total

Maturity profile of financial liabilities 2011 £m £m £m £m £m £m

Insurance contract liabilities 107.8 190.3 184.7 5,405.8 57.6 5,946.2

Investment contract liabilities – – – – 800.9 800.9

Provisions 5.1 46.8 0.4 – – 52.3

Financial liabilities

- Derivative financial instruments – 3.8 – – – 3.8

- Other financial liabilities 66.8 5.9 – – – 72.7

Insurance payables 31.6 – – – – 31.6

Trade and other payables 147.4 – – – – 147.4

358.7 246.8 185.1 5,405.8 858.5 7,054.9

iv) Other risk types

Operational risk

Operational risk is the risk of loss, resulting from inadequate or failed internal processes, systems, human error or from external events,

including legal and regulatory risk.

Senior managers are responsible for the identification, assessment, control and monitoring of operational risks and for reporting these to the

Risk Committee in accordance with the Group’s escalation criteria. Operational risks are assessed in terms of their probability and impact in

accordance with Group policy.

Group risk

Group risk is the risk of contagion that the Society incurs from its membership of a group of firms. The Group Risk Committee oversees the

management of such risks.

Strategic risk

Strategic risk is the risk arising from the implementation of agreed strategy. It includes risks arising from political, economic, sociological and

technological changes, competitor actions and capital adequacy.

Executive management identifies strategic risks when drawing up business plans for approval by the Board and monitors these, ensuring that

excess risk is reported to the Group Risk Committee and Board.