Our Accounts 107

Notes to the financial statements continued

31 December 2012

Taxation

This section presents information relating to tax charge and movements in the corporation and deferred tax assets and liabilities held

by the Society and Group.

34. Income tax expense

- Current income tax

Current income tax liabilities and assets are measured at the amount expected to be paid to or recovered from the taxation authorities.

The tax rates and tax laws used to compute the amount are those that are enacted or substantively enacted at the Statement of

Financial Position date.

- Deferred income tax

Deferred income tax is recognised, using the liability method, on temporary differences arising between the tax bases of assets and

liabilities and their carrying amounts in the consolidated financial statements. Deferred income tax is determined using tax rates

(and laws) that have been enacted or substantively enacted by the Statement of Financial Position date and are expected to apply when the

related deferred income tax asset is realised or the deferred income tax liability is settled. Deferred income tax assets are recognised to the

extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised.

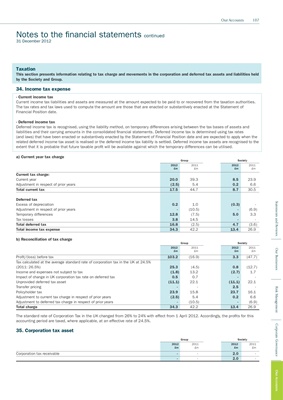

a) Current year tax charge

Group Society

2012 2011 2012 2011

£m £m £m £m

Current tax charge:

Current year 20.0 39.3 8.5 23.9

Adjustment in respect of prior years (2.5) 5.4 0.2 6.6

Total current tax 17.5 44.7 8.7 30.5

Deferred tax

Statements and Reviews

Excess of depreciation 0.2 1.0 (0.3) -

Adjustment in respect of prior years - (10.5) - (6.9)

Temporary differences 12.8 (7.5) 5.0 3.3

Tax losses 3.8 14.5 - -

Total deferred tax 16.8 (2.5) 4.7 (3.6)

Total income tax expense 34.3 42.2 13.4 26.9

b) Reconciliation of tax charge

Group Society

2012 2011 2012 2011

Our Businesses

£m £m £m £m

Profit/(loss) before tax 103.2 (16.9) 3.3 (47.7)

Tax calculated at the average standard rate of corporation tax in the UK at 24.5%

(2011: 26.5%) 25.3 (4.5) 0.8 (12.7)

Income and expenses not subject to tax (1.8) 13.2 (2.7) 1.7

Impact of change in UK corporation tax rate on deferred tax 0.5 0.7 - -

Unprovided deferred tax asset (11.1) 22.1 (11.1) 22.1

Transfer pricing - - 2.5 -

Risk Management

Policyholder tax 23.9 15.8 23.7 16.1

Adjustment to current tax charge in respect of prior years (2.5) 5.4 0.2 6.6

Adjustment to deferred tax charge in respect of prior years - (10.5) - (6.9)

Total charge 34.3 42.2 13.4 26.9

The standard rate of Corporation Tax in the UK changed from 26% to 24% with effect from 1 April 2012. Accordingly, the profits for this

accounting period are taxed, where applicable, at an effective rate of 24.5%.

Corporate Governance

35. Corporation tax asset

Group Society

2012 2011 2012 2011

£m £m £m £m

Corporation tax receivable - - 2.0 -

- - 2.0 -

Our Accounts