68 LV= Annual Report 2012

Notes to the Financial Statements continued

31 December 2012

3. Risk management and control (continued)

Currency risk

The Group is exposed to foreign currency exchange risk within the investment portfolio supporting the Group’s operations from purchased

investments that are denominated or payable in currencies other than sterling. There is no other exposure to currency risk.

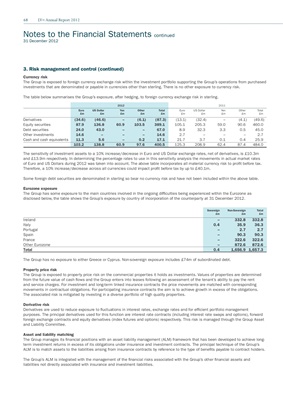

The table below summarises the Group’s exposure, after hedging, to foreign currency exchange risk in sterling.

2012 2011

Euro US Dollar Yen Other Total Euro US Dollar Yen Other Total

£m £m £m £m £m £m £m £m £m £m

Derivatives (34.6) (46.6) – (6.1) (87.3) (13.1) (32.4) – (4.1) (49.6)

Equity securities 87.9 136.8 60.9 103.5 389.1 105.1 205.3 59.0 90.6 460.0

Debt securities 24.0 43.0 – – 67.0 8.9 32.3 3.3 0.5 45.0

Other investments 14.6 – – – 14.6 2.7 – – – 2.7

Cash and cash equivalents 11.3 5.6 – 0.2 17.1 21.7 3.7 0.1 0.4 25.9

103.2 138.8 60.9 97.6 400.5 125.3 208.9 62.4 87.4 484.0

The sensitivity of investment assets to a 10% increase/decrease in Euro and US Dollar exchange rates, net of derivatives, is £10.3m

and £13.9m respectively. In determining the percentage rates to use in this sensitivity analysis the movements in actual market rates

of Euro and US Dollars during 2012 was taken into account. The above table incorporates all material currency risk to profit before tax.

Therefore, a 10% increase/decrease across all currencies could impact profit before tax by up to £40.1m.

Some foreign debt securities are denominated in sterling so bear no currency risk and have not been included within the above table.

Eurozone exposure

The Group has some exposure to the main countries involved in the ongoing difficulties being experienced within the Eurozone as

disclosed below, the table shows the Group’s exposure by country of incorporation of the counterparty at 31 December 2012.

Sovereign Non-Sovereign Total

£m £m £m

Ireland – 332.8 332.8

Italy 0.4 35.9 36.3

Portugal – 2.7 2.7

Spain – 90.3 90.3

France – 322.6 322.6

Other Eurozone – 872.6 872.6

Total 0.4 1,656.9 1,657.3

The Group has no exposure to either Greece or Cyprus. Non-sovereign exposure includes £74m of subordinated debt.

Property price risk

The Group is exposed to property price risk on the commercial properties it holds as investments. Values of properties are determined

from the future value of cash flows and the Group enters into leases following an assessment of the tenant’s ability to pay the rent

and service charges. For investment and long-term linked insurance contracts the price movements are matched with corresponding

movements in contractual obligations. For participating insurance contracts the aim is to achieve growth in excess of the obligations.

The associated risk is mitigated by investing in a diverse portfolio of high quality properties.

Derivative risk

Derivatives are used to reduce exposure to fluctuations in interest rates, exchange rates and for efficient portfolio management

purposes. The principal derivatives used for this function are interest rate contracts (including interest rate swaps and options), forward

foreign exchange contracts and equity derivatives (index futures and options) respectively. This risk is managed through the Group Asset

and Liability Committee.

Asset and liability matching

The Group manages its financial positions with an asset liability management (ALM) framework that has been developed to achieve long-

term investment returns in excess of its obligations under insurance and investment contracts. The principal technique of the Group’s

ALM is to match assets to the liabilities arising from insurance contracts by reference to the type of benefits payable to contract holders.

The Group’s ALM is integrated with the management of the financial risks associated with the Group’s other financial assets and

liabilities not directly associated with insurance and investment liabilities.