Our Accounts 71

Notes to the Financial Statements continued

31 December 2012

3. Risk management and control (continued)

iii) Liquidity risk

Liquidity risk is the risk that the Group does not have sufficient available liquid assets to meet its obligations as they fall due.

Sources of liquidity risk have been identified and systems are in place to measure, monitor and control liquidity exposures.

These are documented in liquidity policies.

Liquidity is maintained at a prudent level, with a buffer to cover contingencies including the provision of temporary liquidity to

subsidiary companies.

The maturity of the financial assets of the Group has been disclosed within the individual notes to the financial statements.

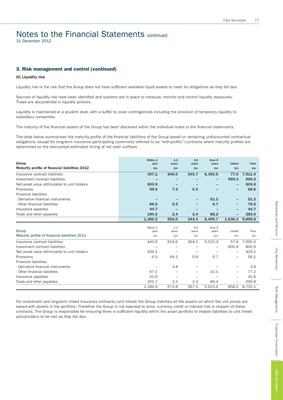

The table below summarises the maturity profile of the financial liabilities of the Group based on remaining undiscounted contractual

obligations, except for long-term insurance participating (commonly referred to as “with-profits”) contracts where maturity profiles are

determined on the discounted estimated timing of net cash outflows.

Within 1 1-3 3-5 Over 5

Group year years years years Linked Total

Maturity profile of financial liabilities 2012 £m £m £m £m £m £m

Insurance contract liabilities 497.1 646.0 340.7 6,350.6 77.0 7,911.4

Investment contract liabilities – – – – 959.3 959.3

Net asset value attributable to unit holders 503.9 – – – – 503.9

Provisions 59.0 7.3 0.3 – – 66.6

Financial liabilities

- Derivative financial instruments – – – 51.2 – 51.2

Statements and Reviews

- Other financial liabilities 65.5 0.3 – 9.7 – 75.5

Insurance payables 44.7 – – – – 44.7

Trade and other payables 190.0 2.4 2.4 88.2 – 283.0

1,360.2 656.0 343.4 6,499.7 1,036.3 9,895.6

Within 1 1-3 3-5 Over 5

Group year years years years Linked Total

Maturity profile of financial liabilities 2011 £m £m £m £m £m £m

Insurance contract liabilities 443.9 619.6 364.1 5,515.4 57.6 7,000.6

Investment contract liabilities -– – – – 800.9 800.9

Our Businesses

Net asset value attributable to unit holders 429.1 – – – – 429.1

Provisions 6.5 48.1 0.8 0.7 – 56.1

Financial liabilities

- Derivative financial instruments – 3.8 – – – 3.8

- Other financial liabilities 67.1 – – 10.1 – 77.2

Insurance payables 41.6 – – – – 41.6

Trade and other payables 201.7 2.3 2.4 89.4 – 295.8

1,189.9 673.8 367.3 5,615.6 858.5 8,705.1

Risk Management

For investment and long-term linked insurance contracts (unit linked) the Group matches all the assets on which the unit prices are

based with assets in the portfolio. Therefore the Group is not exposed to price, currency, credit or interest risk in respect of these

contracts. The Group is responsible for ensuring there is sufficient liquidity within the asset portfolio to enable liabilities to unit linked

policyholders to be met as they fall due.

Corporate Governance

Our Accounts