Our Accounts 73

Notes to the Financial Statements continued

31 December 2012

Performance

The notes included within this section focus on the performance and results of the Society and Group. Information on the income generated,

benefits and claims paid, expenditure incurred and mutual bonus declared are presented here.

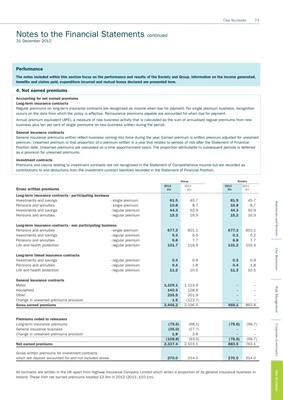

4. Net earned premiums

Accounting for net earned premiums

Long-term insurance contracts

Regular premiums on long-term insurance contracts are recognised as income when due for payment. For single premium business, recognition

occurs on the date from which the policy is effective. Reinsurance premiums payable are accounted for when due for payment.

Annual premium equivalent (APE), a measure of new business activity that is calculated as the sum of annualised regular premiums from new

business plus ten per cent of single premiums on new business written during the period.

General insurance contracts

General insurance premiums written reflect business coming into force during the year. Earned premium is written premium adjusted for unearned

premium. Unearned premium is that proportion of a premium written in a year that relates to periods of risk after the Statement of Financial

Position date. Unearned premiums are calculated on a time apportionment basis. The proportion attributable to subsequent periods is deferred

as a provision for unearned premiums.

Investment contracts

Premiums and claims relating to investment contracts are not recognised in the Statement of Comprehensive Income but are recorded as

contributions to and deductions from the investment contract liabilities recorded in the Statement of Financial Position.

Group Society

2012 2011 2012 2011

Gross written premiums £m £m £m £m

Long-term insurance contracts - participating business

Investments and savings - single premium 61.5 45.7 61.5 45.7

Statements and Reviews

Pensions and annuities - single premium 10.8 8.7 10.8 8.7

Investments and savings - regular premium 44.3 52.9 44.3 52.9

Pensions and annuities - regular premium 15.2 16.9 15.2 16.9

Long-term insurance contracts - non participating business

Pensions and annuities - single premium 677.3 601.1 677.3 601.1

Investments and savings - regular premium 0.3 0.5 0.1 0.2

Pensions and annuities - regular premium 6.8 7.7 6.8 7.7

Life and health protection - regular premium 131.7 116.9 131.2 116.4

Our Businesses

Long-term linked insurance contracts

Investments and savings - regular premium 0.3 0.9 0.3 0.9

Pensions and annuities - regular premium 0.4 1.8 0.4 1.8

Life and health protection - regular premium 11.2 10.5 11.2 10.5

General insurance contracts

Motor 1,109.1 1,124.9 – –

Risk Management

Household 140.3 128.8 – –

Other 235.5 201.9 – –

Change in unearned premiums provision 1.5 (122.7) – –

Gross earned premiums 2,446.2 2,196.5 959.1 862.8

Premiums ceded to reinsurers

Long-term insurance premiums (75.6) (68.1) (75.6) (99.7)

Corporate Governance

General insurance business (35.0) (27.7) – –

Change in unearned premiums provision 1.8 2.8 – –

(108.8) (93.0) (75.6) (99.7)

Net earned premiums 2,337.4 2,103.5 883.5 763.1

Gross written premiums for investment contracts

which are deposit accounted for and not included above 270.0 214.0 270.0 214.0

Our Accounts

All contracts are written in the UK apart from Highway Insurance Company Limited which writes a proportion of its general insurance business in

Ireland. These Irish net earned premiums totalled £3.9m in 2012 (2011: £10.1m).