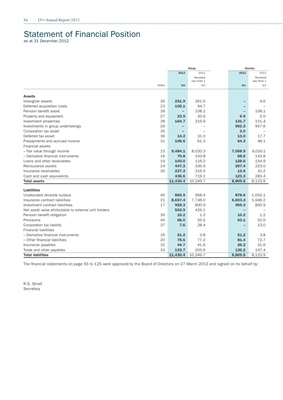

56 LV= Annual Report 2012

Statement of Financial Position

as at 31 December 2012

Group Society

2012 2011 2012 2011

Restated Restated

see Note 1 see Note 1

Notes £m £m £m £m

Assets

Intangible assets 26 251.9 261.5 – 4.6

Deferred acquisition costs 23 100.1 94.7 – –

Pension benefit asset 39 – 108.1 – 108.1

Property and equipment 27 23.9 20.6 6.9 5.0

Investment properties 28 164.7 219.9 131.7 151.4

Investments in group undertakings 29 – – 902.3 957.6

Corporation tax asset 35 – – 2.0 –

Deferred tax asset 36 14.2 31.0 13.0 17.7

Prepayments and accrued income 31 106.6 61.3 64.3 48.1

Financial assets

– Fair value through income 15 9,484.1 8,020.3 7,058.9 6,016.1

– Derivative financial instruments 16 70.8 143.8 68.5 143.8

Loans and other receivables 19 103.0 116.0 128.6 154.9

Reinsurance assets 24 447.2 336.9 297.4 223.0

Insurance receivables 30 227.3 216.5 12.6 10.2

Cash and cash equivalents 436.6 719.1 123.3 283.4

Total assets 11,430.4 10,349.7 8,809.5 8,123.9

Liabilities

Unallocated divisible surplus 46 860.9 958.4 878.6 1,055.1

Insurance contract liabilities 21 8,657.4 7,748.0 6,603.3 5,946.2

Investment contract liabilities 17 959.3 800.9 959.3 800.9

Net asset value attributable to external unit holders 503.9 429.1 – –

Pension benefit obligation 39 10.2 1.2 10.2 1.2

Provisions 40 66.0 55.5 63.1 52.0

Corporation tax liability 37 7.6 28.4 – 13.0

Financial liabilities

– Derivative financial instruments 16 51.2 3.8 51.2 3.8

– Other financial liabilities 20 75.5 77.2 81.4 72.7

Insurance payables 32 44.7 41.6 26.2 31.6

Trade and other payables 33 193.7 205.6 136.2 147.4

Total liabilities 11,430.4 10,349.7 8,809.5 8,123.9

The financial statements on page 55 to 125 were approved by the Board of Directors on 27 March 2013 and signed on its behalf by:

R.S. Small

Secretary