Our Accounts 69

Notes to the Financial Statements continued

31 December 2012

3. Risk management and control (continued)

Summary of market risk sensitivities

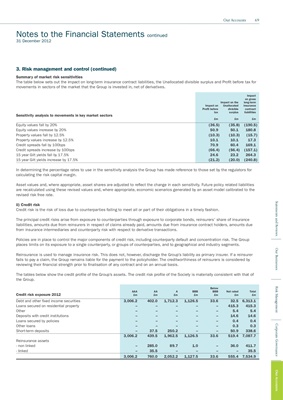

The table below sets out the impact on long-term insurance contract liabilities, the Unallocated divisible surplus and Profit before tax for

movements in sectors of the market that the Group is invested in, net of derivatives.

Impact

on gross

Impact on the long-term

Impact on Unallocated insurance

Profit before divisible contract

tax surplus liabilities

Sensitivity analysis to movements in key market sectors

£m £m £m

Equity values fall by 20% (36.5) (35.8) (190.5)

Equity values increase by 20% 50.9 50.1 180.8

Property values fall by 12.5% (10.3) (10.3) (15.7)

Property values increase by 12.5% 10.1 10.1 17.3

Credit spreads fall by 100bps 70.9 60.4 169.1

Credit spreads increase by 100bps (66.4) (56.4) (157.1)

15 year Gilt yields fall by 17.5% 24.6 23.2 264.3

15 year Gilt yields increase by 17.5% (21.2) (20.0) (240.8)

In determining the percentage rates to use in the sensitivity analysis the Group has made reference to those set by the regulators for

calculating the risk capital margin.

Asset values and, where appropriate, asset shares are adjusted to reflect the change in each sensitivity. Future policy related liabilities

are recalculated using these revised values and, where appropriate, economic scenarios generated by an asset model calibrated to the

revised risk free rate.

Statements and Reviews

ii) Credit risk

Credit risk is the risk of loss due to counterparties failing to meet all or part of their obligations in a timely fashion.

The principal credit risks arise from exposure to counterparties through exposure to corporate bonds, reinsurers’ share of insurance

liabilities, amounts due from reinsurers in respect of claims already paid, amounts due from insurance contract holders, amounts due

from insurance intermediaries and counterparty risk with respect to derivative transactions.

Policies are in place to control the major components of credit risk, including counterparty default and concentration risk. The Group

places limits on its exposure to a single counterparty, or groups of counterparties, and to geographical and industry segments.

Our Businesses

Reinsurance is used to manage insurance risk. This does not, however, discharge the Group’s liability as primary insurer. If a reinsurer

fails to pay a claim, the Group remains liable for the payment to the policyholder. The creditworthiness of reinsurers is considered by

reviewing their financial strength prior to finalisation of any contract and on an annual basis.

The tables below show the credit profile of the Group’s assets. The credit risk profile of the Society is materially consistent with that of

the Group.

Risk Management

Below

AAA AA A BBB BBB Not rated Total

Credit risk exposure 2012 £m £m £m £m £m £m £m

Debt and other fixed income securities 3,006.2 402.0 1,712.3 1,126.5 33.6 32.5 6,313.1

Loans secured on residential property – – – – – 415.3 415.3

Other – – – – – 5.4 5.4

Deposits with credit institutions – – – – – 14.6 14.6

Loans secured by policies – – – – – 0.4 0.4

– – – – – 0.3 0.3

Corporate Governance

Other loans

Short-term deposits – 37.5 250.2 – – 50.9 338.6

3,006.2 439.5 1,962.5 1,126.5 33.6 519.4 7,087.7

Reinsurance assets

- non linked – 285.0 89.7 1.0 – 36.0 411.7

- linked – 35.5 – – – – 35.5

3,006.2 760.0 2,052.2 1,127.5 33.6 555.4 7,534.9

Our Accounts