116 LV= Annual Report 2012

Notes to the financial statements continued

31 December 2012

Provisions, contingent liabilities and commitments

This section describes the provisions, contingent liabilities and commitments of the Society and Group arising from the ongoing life

and general insurance businesses and the exit from the banking and asset management businesses in prior years.

40. Provisions

Accounting for provisions

Provisions are recognised when the Group has a present legal or constructive obligation as a result of past events, it is more likely than

not that an outflow of resources will be required to settle the obligation and the amount has been reliably estimated. Where the Group

expects some or all of a provision to be reimbursed it is recognised as a separate asset when the reimbursement is certain.

Provisions are measured at the present value of the expenditure required to settle the obligation using a pre-tax rate that reflects current

market assessments of the time value of money and the risks specific to the obligation.

The expense relating to provisions is presented in the Statement of Comprehensive Income.

Onerous contracts

A provision is made for onerous contracts in which the unavoidable costs of meeting the obligation exceed the expected future economic

benefits.

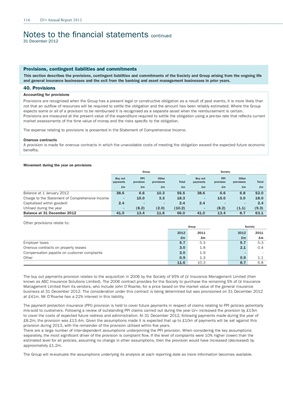

Movement during the year on provisions

Group Society

Buy out PPI Other Buy out PPI Other

payments provision provisions Total payments provision provisions Total

£m £m £m £m £m £m £m £m

Balance at 1 January 2012 38.6 6.6 10.3 55.5 38.6 6.6 6.8 52.0

Charge to the Statement of Comprehensive Income - 15.0 3.3 18.3 - 15.0 3.0 18.0

Capitalised within goodwill 2.4 - - 2.4 2.4 - - 2.4

Utilised during the year - (8.2) (2.0) (10.2) - (8.2) (1.1) (9.3)

Balance at 31 December 2012 41.0 13.4 11.6 66.0 41.0 13.4 8.7 63.1

Other provisions relate to:

Group Society

2012 2011 2012 2011

£m £m £m £m

Employer taxes 5.7 5.3 5.7 5.3

Onerous contracts on property leases 3.0 1.8 2.1 0.4

Compensation payable on customer complaints 2.0 1.9 - -

Other 0.9 1.3 0.9 1.1

11.6 10.3 8.7 6.8

The buy out payments provision relates to the acquisition in 2006 by the Society of 95% of LV Insurance Management Limited (then

known as ABC Insurance Solutions Limited). The 2006 contract provides for the Society to purchase the remaining 5% of LV Insurance

Management Limited from its vendors, who include John O’Roarke, for a price based on the market value of the general insurance

business at 31 December 2012. The consideration under this contract is being determined but was provisioned on 31 December 2012

at £41m. Mr O’Roarke has a 22% interest in this liability.

The payment protection insurance (PPI) provision is held to cover future payments in respect of claims relating to PPI policies potentially

mis-sold to customers. Following a review of outstanding PPI claims carried out during the year LV= increased the provision by £15m

to cover the costs of expected future redress and administration. At 31 December 2012, following payments made during the year of

£8.2m, the provision was £13.4m. Given the assumptions made it is expected that up to £10m of payments will be set against this

provision during 2013, with the remainder of the provision utilised within five years.

There are a large number of inter-dependent assumptions underpinning the PPI provision. When considering the key assumptions

separately, the most significant driver of the provision is complaint flow. If the level of complaints were 10% higher (lower) than the

estimated level for all policies, assuming no change in other assumptions, then the provision would have increased (decreased) by

approximately £1.2m.

The Group will re-evaluate the assumptions underlying its analysis at each reporting date as more information becomes available.