Our Accounts 91

Notes to the Financial Statements continued

31 December 2012

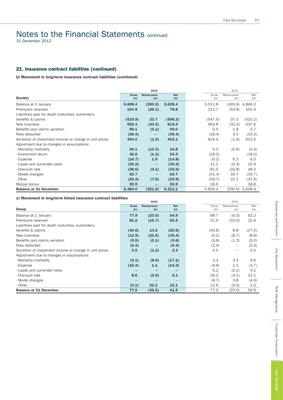

21. Insurance contract liabilities (continued)

b) Movement in long-term insurance contract liabilities (continued)

2012 2011

Gross Reinsurance Net Gross Reinsurance Net

Society £m £m £m £m £m £m

Balance at 1 January 5,828.4 (200.0) 5,628.4 5,011.8 (165.6) 4,846.2

Premiums received 104.9 (26.1) 78.8 215.7 (53.8) 161.9

Liabilities paid for death maturities, surrenders,

benefits & claims (619.9) 23.7 (596.2) (547.5) 37.3 (510.2)

New business 652.4 (33.2) 619.2 569.8 (32.2) 537.6

Benefits and claims variation 99.1 (0.1) 99.0 0.9 1.8 2.7

Fees deducted (36.4) – (36.4) (18.4) 3.1 (15.3)

Accretion of investment income or change in unit prices 404.0 (1.9) 402.1 614.4 (1.9) 612.5

Adjustment due to changes in assumptions:

- Mortality/morbidity 30.1 (13.3) 16.8 0.2 (0.6) (0.4)

- Investment return 35.6 (1.3) 34.3 (18.0) - (18.0)

- Expense (16.7) 1.9 (14.8) (0.2) 6.2 6.0

- Lapse and surrender rates (30.2) – (30.2) 11.2 (0.3) 10.9

- Discount rate (28.5) (4.1) (32.6) 81.0 (32.8) 48.2

- Model changes 62.7 – 62.7 (51.4) 16.7 (34.7)

- Other (22.4) (7.5) (29.9) (59.7) 22.1 (37.6)

Mutual bonus 20.9 – 20.9 18.6 – 18.6

Balance at 31 December 6,484.0 (261.9) 6,222.1 5,828.4 (200.0) 5,628.4

c) Movement in long-term linked insurance contract liabilities

2012 2011

Statements and Reviews

Gross Reinsurance Net Gross Reinsurance Net

Group £m £m £m £m £m £m

Balance at 1 January 77.9 (23.0) 54.9 68.7 (6.5) 62.2

Premiums received 81.2 (15.7) 65.5 31.9 (10.0) 21.9

Liabilities paid for death maturities, surrenders,

benefits & claims (40.8) 14.2 (26.6) (35.8) 8.8 (27.0)

New business (12.9) (22.5) (35.4) (0.1) (8.7) (8.8)

Benefits and claims variation (9.5) (0.1) (9.6) (3.8) (1.2) (5.0)

Fees deducted (6.4) – (6.4) (2.4) – (2.4)

Our Businesses

Accretion of investment income or change in unit prices 3.5 (1.2) 2.3 0.5 – 0.5

Adjustment due to changes in assumptions:

- Mortality/morbidity (9.1) (8.0) (17.1) 3.2 3.4 6.6

- Expense (15.4) 1.1 (14.3) (4.8) 1.1 (3.7)

- Lapse and surrender rates – – – 0.2 (0.1) 0.1

- Discount rate 8.6 (2.5) 6.1 16.2 (4.1) 12.1

- Model changes – – – (8.7) 3.8 (4.9)

- Other (0.1) 22.2 22.1 12.8 (9.5) 3.3

Risk Management

Balance at 31 December 77.0 (35.5) 41.5 77.9 (23.0) 54.9

Corporate Governance

Our Accounts