Our Accounts 79

Notes to the Financial Statements continued

31 December 2012

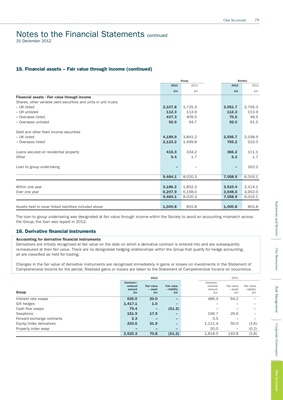

15. Financial assets – Fair value through income (continued)

Group Society

2012 2011 2012 2011

£m £m £m £m

Financial assets - Fair value through income

Shares, other variable yield securities and units in unit trusts

– UK listed 2,107.8 1,725.3 3,051.7 2,756.3

– UK unlisted 112.3 113.9 112.3 113.9

– Overseas listed 437.3 409.5 70.5 48.5

– Overseas unlisted 92.9 94.7 92.0 91.5

Debt and other fixed income securities

– UK listed 4,189.9 3,841.2 2,595.7 2,198.9

– Overseas listed 2,123.2 1,499.8 765.2 532.0

Loans secured on residential property 415.3 334.2 366.2 111.1

Other 5.4 1.7 5.3 1.7

Loan to group undertaking – – – 162.2

9,484.1 8,020.3 7,058.9 6,016.1

Within one year 3,186.2 1,852.3 3,510.4 2,114.1

Over one year 6,297.9 6,168.0 3,548.5 3,902.0

9,484.1 8,020.3 7,058.9 6,016.1

Statements and Reviews

Assets held to cover linked liabilities included above 1,000.8 855.8 1,000.8 855.8

The loan to group undertaking was designated at fair value through income within the Society to avoid an accounting mismatch across

the Group, the loan was repaid in 2012.

16. Derivative financial instruments

Accounting for derivative financial instruments

Derivatives are initially recognised at fair value on the date on which a derivative contract is entered into and are subsequently

re-measured at their fair value. There are no designated hedging relationships within the Group that qualify for hedge accounting,

Our Businesses

all are classified as held for trading.

Changes in the fair value of derivative instruments are recognised immediately in gains or losses on investments in the Statement of

Comprehensive Income for the period. Realised gains or losses are taken to the Statement of Comprehensive Income on occurrence.

2012 2011

Contract/ Contract/

notional Fair value Fair value notional Fair value Fair value

Risk Management

amount – asset – liability amount – asset – liability

Group £m £m £m £m £m £m

Interest rate swaps 635.0 20.0 – 486.9 64.2 –

Gilt hedges 1,417.1 1.0 – – – –

Cash flow swaps 79.4 – (51.2) – – –

Swaptions 151.9 17.9 – 196.7 29.6 –

Forward exchange contracts 3.3 – – 3.5 – –

Equity/index derivatives 233.6 31.9 – 1,111.4 50.0 (3.6)

Corporate Governance

Property index swap – – – 20.0 – (0.2)

2,520.3 70.8 (51.2) 1,818.5 143.8 (3.8)

Our Accounts