Our Accounts 113

Notes to the financial statements continued

31 December 2012

39. Pension benefit asset/(obligation) (continued)

ii) LV Scheme (continued)

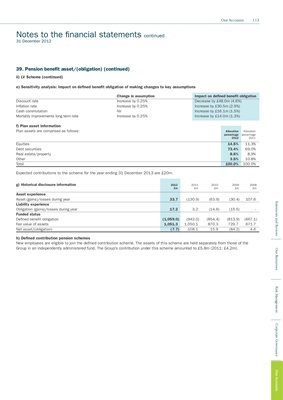

e) Sensitivity analysis: Impact on defined benefit obligation of making changes to key assumptions

Change in assumption Impact on defined benefit obligation

Discount rate Increase by 0.25% Decrease by £48.0m (4.6%)

Inflation rate Increase by 0.25% Increase by £30.5m (2.9%)

Cash commutation Nil Increase by £16.1m (1.5%)

Mortality improvements long term rate Increase by 0.25% Increase by £14.0m (1.3%)

f) Plan asset information

Plan assets are comprised as follows: Allocation Allocation

percentage percentage

2012 2011

Equities 14.5% 11.3%

Debt securities 73.4% 69.0%

Real estate/property 8.6% 8.9%

Other 3.5% 10.8%

Total 100.0% 100.0%

Expected contributions to the scheme for the year ending 31 December 2013 are £20m.

g) Historical disclosure information 2012 2011 2010 2009 2008

£m £m £m £m £m

Asset experience

Asset (gains)/losses during year 33.7 (130.9) (63.9) (30.4) 107.6

Statements and Reviews

Liability experience

Obligation (gains)/losses during year 17.2 3.2 (14.6) (15.5) -

Funded status

Defined benefit obligation (1,059.0) (942.0) (854.4) (813.9) (667.1)

Fair value of assets 1,051.3 1,050.1 870.3 729.7 671.7

Net asset/(obligation) (7.7) 108.1 15.9 (84.2) 4.6

h) Defined contribution pension schemes

New employees are eligible to join the defined contribution scheme. The assets of this scheme are held separately from those of the

Group in an independently administered fund. The Group’s contribution under this scheme amounted to £5.8m (2011: £4.2m).

Our Businesses

Risk Management

Corporate Governance

Our Accounts