102 LV= Annual Report 2012

Notes to the financial statements continued

31 December 2012

27. Property and equipment

Accounting for property and equipment

Operational property and equipment are held at cost less accumulated depreciation. Cost includes the original purchase price of the asset and

the costs attributable to bringing the asset to its working condition for its intended use. Both property and equipment are depreciated on a

straight line basis over their estimated useful lives. The periods used are as follows:

Freehold buildings and finance lease property* 50 years

Leasehold property enhancements* 10 years or lease term if shorter

Fixtures, fittings and motor vehicles 3 to 10 years

IT systems (spend over £1m) 3 years

Provision is made for any impairment in property and equipment.

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each Statement of Financial Position date.

Assets under construction represent the cost of assets under development. These assets are not depreciated, the total cost is transferred

to the appropriate asset class on completion and then depreciated over their estimated useful lives.

*These are properties used by the Group for operational purposes and are not investment properties which are dealt with in Note 28.

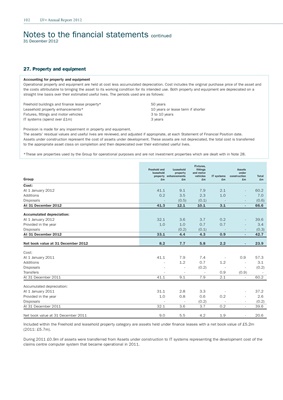

Fixtures,

Freehold and Leasehold fittings Assets

leasehold property and motor under

property enhancements vehicles IT systems construction Total

Group £m £m £m £m £m £m

Cost:

At 1 January 2012 41.1 9.1 7.9 2.1 - 60.2

Additions 0.2 3.5 2.3 1.0 - 7.0

Disposals - (0.5) (0.1) - - (0.6)

At 31 December 2012 41.3 12.1 10.1 3.1 - 66.6

Accumulated depreciation:

At 1 January 2012 32.1 3.6 3.7 0.2 - 39.6

Provided in the year 1.0 1.0 0.7 0.7 - 3.4

Disposals - (0.2) (0.1) - - (0.3)

At 31 December 2012 33.1 4.4 4.3 0.9 - 42.7

Net book value at 31 December 2012 8.2 7.7 5.8 2.2 - 23.9

Cost:

At 1 January 2011 41.1 7.9 7.4 - 0.9 57.3

Additions - 1.2 0.7 1.2 - 3.1

Disposals - - (0.2) - - (0.2)

Transfers - - - 0.9 (0.9) -

At 31 December 2011 41.1 9.1 7.9 2.1 - 60.2

Accumulated depreciation:

At 1 January 2011 31.1 2.8 3.3 - - 37.2

Provided in the year 1.0 0.8 0.6 0.2 - 2.6

Disposals - - (0.2) - - (0.2)

At 31 December 2011 32.1 3.6 3.7 0.2 - 39.6

Net book value at 31 December 2011 9.0 5.5 4.2 1.9 - 20.6

Included within the Freehold and leasehold property category are assets held under finance leases with a net book value of £5.2m

(2011: £5.7m).

During 2011 £0.9m of assets were transferred from Assets under construction to IT systems representing the development cost of the

claims centre computer system that became operational in 2011.