Our Accounts 87

Notes to the Financial Statements continued

31 December 2012

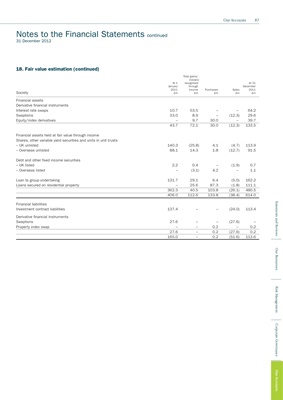

18. Fair value estimation (continued)

Total gains/

(losses)

At 1 recognised At 31

January through December

2011 income Purchases Sales 2011

Society £m £m £m £m £m

Financial assets

Derivative financial instruments

Interest rate swaps 10.7 53.5 – – 64.2

Swaptions 33.0 8.9 – (12.3) 29.6

Equity/index derivatives – 9.7 30.0 – 39.7

43.7 72.1 30.0 (12.3) 133.5

Financial assets held at fair value through income

Shares, other variable yield securities and units in unit trusts

– UK unlisted 140.3 (25.8) 4.1 (4.7) 113.9

– Overseas unlisted 88.1 14.3 1.8 (12.7) 91.5

Debt and other fixed income securities

– UK listed 2.2 0.4 – (1.9) 0.7

– Overseas listed – (3.1) 4.2 – 1.1

Loan to group undertaking 131.7 29.1 6.4 (5.0) 162.2

Loans secured on residential property – 25.6 87.3 (1.8) 111.1

362.3 40.5 103.8 (26.1) 480.5

406.0 112.6 133.8 (38.4) 614.0

Statements and Reviews

Financial liabilities

Investment contract liabilities 137.4 – – (24.0) 113.4

Derivative financial instruments

Swaptions 27.6 – – (27.6) –

Property index swap – – 0.2 – 0.2

27.6 – 0.2 (27.6) 0.2

165.0 – 0.2 (51.6) 113.6

Our Businesses

Risk Management

Corporate Governance

Our Accounts